1.0 Introduction

Establishing a nonprofit organisation in Nevada may be quite formalised and the legal requirements are well laid out hence offering the most practical structure for most organisations. From the perspective of fulfilling the needs of a particular group of people, from the goal of supporting a cause, or from the standpoint of enhancing the overall welfare and progress of society, one cannot underestimate the role of nonprofits. This is good to ensure that a nonprofit is formed so that one can assist in offering solutions to problems that affect society as well as champion the causes of the successful formation of society. The following is a step-by-step guide on how to start a Nonprofit organisation in Nevada by Nevada and Federal laws. It entails choosing a distinguishable and suitable name to acquire a tax-exempt status and ensuring compliance with requirements for sustaining operations.

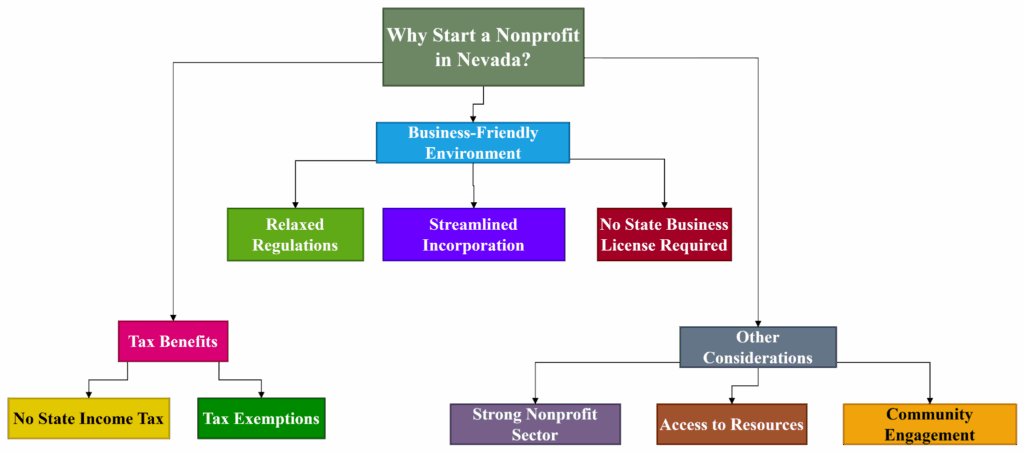

2.0 Why Start a Nonprofit in Nevada?

There are few specific reasons why Nevada is a good state to start a nonprofit organisation such as favourable taxes, fairly simple formalities, friendly rules and regulations. The fact that there is no corporate income tax in the state and has many favourable policies.

Tax Benefits

- No State Income Tax: Unlike common taxes such as the corporate income tax, no money is taken by the Nevada government which makes it easier for nonprofit organisations to increase their revenue for the achievement of their specific objectives.

- Tax Exemptions: Federal tax-exempt nonprofit organisations may also be exempt from paying the Nevada’s corporate income tax, state sales tax and use tax, which cuts on costs.

Business-Friendly Environment

- Relaxed Regulations: Nevada’s nonprofit laws are moderately flexible making the state’s laws very easy to deal with when it comes to issues of compliance and reporting.

- Streamlined Incorporation: The state has a relatively low incorporation fee of $50, and there are also fast processing fees to ensure fast processing of incorporating the nonprofit.

- No State Business License Requirement: Specifically, organisations that are created under NRS Chapter 82 as well as corporations solely established under NRS Chapter 84 are not required to obtain the licence to do business.

Figure 1: Benefits for Nonprofit Organisations in Nevada (Source: Self-Created)

Other Considerations

- Strong Nonprofit Sector: Nevada has about 16000 registered non-profit organisations for non-profit across various sectors making a positive impact and offering employment opportunities in its economy.

- Access to Resources: Nonprofit organisations include the Nevada Community Foundation (NCF), which offers financial management company, strategic planning as well as administrative support.

- Community Engagement: It became very effective since its establishment of forming a nonprofit in Nevada helps the organisations to locally meet the needs as well as enjoying the system that is friendly for business development.

Nonprofit organisations may find a lot of value in operating in Nevada due to tax benefits, low regulatory and bureaucratic pressures, and a supportive network.

3.0 Choosing the Right Name for a Nonprofit

When choosing a legal name for the nonprofit organisation it is important to choose a unique name. The following processes can be observed in choosing and registering a nonprofit’s name in Nevada as presented in the table below.

| Factor | Details | Requirement/Action |

| Distinguishability | Ensuring the name is unique and does not conflict with existing entities in Nevada. | Conducting a name search to ensure availability. |

| Name Search | Conducting a preliminary search on the Nevada Secretary of State’s website to check availability. | Using the online database for checking name conflicts. |

| Corporate Suffix | Including a suffix like “Inc.,” “Ltd.,” “Co.,” or “Corp.” if the name resembles a natural person’s name. | Adding the appropriate suffix if necessary. |

| Mission Alignment | Choosing a name that reflects the nonprofit’s purpose to attract donors and supporters. | Ensuring the name conveys the organization’s mission clearly. |

| Avoiding Vague Terms | Using specific language to ensure clarity about the nonprofit’s goals and purpose. | Avoiding generic terms that may create confusion. |

| Purpose Statement | Providing a description of the nonprofit’s purpose, aligning with IRS guidelines for 501(c)(3) status. | Ensuring the statement meets both state and federal requirements. |

| Filing Requirements | Including the selected name in the articles of incorporation. | Filing the articles of incorporation with the Nevada Secretary of State. |

| Registered Agent | Appointing a designated registered agent with a Nevada street address to receive official notices. | Listing the registered agent in the incorporation documents. |

| Board Members | Listing the names and addresses of the initial board of directors or trustees. | Including all board members in the incorporation documents. |

| Legal Name | Providing the full legal name as filed with the Secretary of State and, if different, with the IRS. | Ensuring consistency between state and federal filings. |

Table 1: Nonprofit Organisation Naming Procedure. (Source: Self-Created)

4.0 Filing Articles of Incorporation for Nonprofits

1. Name of Corporation

The nonprofit’s name should not be similar to a similar business name that has already been registered with the Nevada Secretary of State. Also, if it seems that the name belongs to a natural person, then the name must be followed by a corporate suffix as “Incorporated”, “Inc.,” “Corporation” or “Corp.” A good way to check the availability of a business name is to perform an initial search on the Internet, specifically on the Nevada Secretary of State’s webpage.

2. Registered Agent

A business must be officially appointed; it must include its street address, situated in Nevada. The registered agent is responsible for the receipt of all legal papers and other documents that relate to this nonprofit issued by the government.

3. Directors/Trustees

Specifically, the name and address of the initial board of directors or board of trustees should be given. They will manage the governance of this nonprofit organisation and would be responsible for overseeing compliance on the state and federal level.

4. Purpose Statement

The Nevada law mandates that nonprofits include a short provision stating the corporation’s purposes. If the organisation is planning to apply for the 501(c)(3) Federal tax exemption category, it is mandatory to include words that meet IRS’ legal specifications. This makes the nonprofit eligible for certain tax exemptions and is also in line with the Federation’s policies on accountability.

5. Incorporator(s)

The Articles of Incorporation must be filed and this can only be done by an incorporator. Usually, this person is not a member of the nonprofit but has the authority to file the articles of incorporation.

6. Certificate of Acceptance

The registered agent also has to acknowledge the appointment by either signing the articles or by completing and filing a Registered Agent Acceptance Form with the Nevada Secretary of State. This step certifies that the agent is ready to assume the position of the agent in the contract for the client.

Additional Filing Considerations

Nevada provides various forms of nonprofit corporations and each of them is regulated by various legal aspects. The following are among the main forms of nonprofit organisation and their structures of formation.

| Type of Nonprofit | Governing Statute | Filing Requirements |

| Nonprofit Corporation | NRS Chapter 82 | Articles of Incorporation, Annual List of Officers and Directors |

| Nonprofit Cooperative Corporation (Without Stock) | NRS 81.410-81.540 | Articles of Incorporation, Annual List of Officers and Directors |

| Cooperative Association | NRS 81.170-81.270 | Articles of Association, Annual List of Officers and Directors, Business License Application |

Table 2: Nonprofit Organisation Types (Source: Self-Created)

Most nonprofit filings can be done online via the official website of the Nevada Secretary of State. Completing all necessary paperwork correctly and on time is beneficial in minimising the overcoming of several steps in the course of incorporating a nonprofit company.

5.0 Obtaining Tax-Exempt Status (501(c)(3))

According to the tax laws put in place by the federal government of the United States of America, a nonprofit has to apply for approval under the code 501(c)(3). The following steps outline the process:

| Step | Description | Additional Details |

| Obtain an EIN | Apply for an Employer Identification Number (EIN) from the IRS. | The EIN serves as the nonprofit’s tax identification number. It is required for tax filings and banking purposes. |

| Complete Form 990 or 990-EZ | Choose the appropriate IRS application form. | Form 990 (long version) is required for larger nonprofits. Form 990-EZ (short version) is for smaller organizations with annual gross receipts under $50,000. |

| Submit the Application and Pay Fees | File the selected form with the IRS and pay the application fee. | Fees range from $275 to $600, depending on the form used. |

| Await IRS Determination | The IRS reviews the application and issues a determination letter. | Approval can take several months. Once granted, the nonprofit is officially recognised as tax-exempt. |

Table 3: Tax-Exempt Process (Source: Self-Created)

There are certain benefits associated with getting the 501(c)(3) that give a non-profit organisation a lot of advantages in terms of its financial and operational capacity. It has some benefits in terms of the fact that the organisation does not have to pay federal income tax, freeing up more funds for the organisation’s use. Also, contributions presented for fundraising are allowed tax deductions for the donors; making fundraising easier. There seem to be significant grant and funding opportunities that are exclusively for tax-exempt organisations hence adding to financial possibility. It has the added advantage of improving the organisation’s reputation together with donors, partners, and even government bodies. In addition, state tax exemptions, as well as low postal rates can be obtained by nonprofit organisations.

Finally, getting 501(c)(3) status supports the missions and aims of the organisation while increasing financial stability in its operations.

6.0 Required Licenses and Ongoing Compliance

In Nevada, no state business licence is required for new 501(c)(3) organisations. Still, if such an organisation requires fundraising, it has to do so through the Nevada Secretary of State. Also, to remain in good standing, nonprofits need to provide an annual list of officers and directors.

As it will be observed, nonprofits require constant reporting to meet state and federal standards. This includes registering the LLC company at the Nevada Secretary of State through filing a document called Annual List of Officers, Directors, and Resident Agent and in case the LLC is soliciting for charity then filing a Charitable Solicitation Registration Statement.

Tax-exempt organisations filing with the IRS include Form 990 or 990-EZ for nonprofits and Form 990-PF for private foundations which are due annually. Even the Nonprofit organisation that has not registered as 501(c) tax-exempt must also follow the Beneficial Ownership Information (BOI). Any organisation incorporated before December 31 2024 is required to file their BOI within this date while those formed after must submit it within thirty (30) days of their incorporation.

Compliance is also concerned with fundraising regulations, reporting standards, and other governance rules. It is mandatory for nonprofits who want to legally solicit funds in Nevada to update their registration every year.

| Requirement | Details | Frequency |

| State Business License | Not required for Nevada nonprofits | One-time |

| Charitable Solicitation Registration | Required if soliciting donations | Annually |

| Annual List of Officers & Directors | Must be filed with the Nevada Secretary of State | Annually |

| IRS Form 990 / 990-EZ | Required for tax-exempt nonprofits | Annually |

| Form 990-PF | Required for private foundations | Annually |

| Beneficial Ownership Information (BOI) | Required for non-501(c) nonprofits | By deadline (varies) |

| Fundraising & Financial Compliance | Must follow all applicable state and federal laws | Ongoing |

Table 4: Required Licenses and Ongoing Compliance (Source: Self-Created)

7.0 Conclusion

The process of forming a nonprofit organisation in Nevada is very straightforward and it comes with some advantages like taxation. Exemptions such as no corporate income tax makes it easier for organisations to manage their resources. Simplification of incorporation processes and exemption impose lesser bureaucratic and financial pressure. The research explores how present strong and active nonprofit sector in Nevada offer resources and the opportunities for the community. Thus, the constant fulfilment of the IRS and state legal requirements means the possibility to maintain sustainability of the company operations. Non-profits are an important part of the community and whether a facility exists, or there is a lack of one, solutions could be found.

Leave a Reply