1. Overview of Business Funding Options

In the United States, particularly in Nevada state which promotes entrepreneurship through favorable business policies and continuously advancing entrepreneurship infrastructure. It also helps new business owners have several funding sources available to them. These are the basic forms of financing and some of them include traditional loans, grants, angel investors, venture capital, crowding funding platforms, and other models of financing. It is for this reason that the appropriateness of one or another funding source depends not only on the type of business growth prospects but also on the field of activity and the financial experience of the founder.

The optimal financing strategy should be selected right after launching a business idea to have positive impacts on its sustainability and effectiveness. One such important factor is tax policies that exist in the state and Nevada has very favorable policies in this area for the growth of startups. It does not have corporate income tax, Personal income tax, or Franchise tax which makes it one of the best places for doing business for both investors and businessmen. Obtaining the necessary funds still poses certain challenges to researchers and requires effort, time, and intellect. This report will seek to discuss possible funding sources that a new business in Nevada can consider including grants and loans offered by the state, equity funding, and other methods that include crowdfunding.

2. Nevada Small Business Grants and Loans

Nevada has several startup and small business grants/loan programs that offer some of the capital needs of new businesses. These options provide funding to the entrepreneurs whether starting up businesses or expanding their businesses. Although it is also important and easy to obtain through the availability of business grants because they do not need to be paid back, these funds entail strict conditions for applications and compliance. On the other hand, loans are easier to obtain but are to be repaid with the added interest. Any startup company located in Nevada needs to understand how to properly utilise both.

Government Grants

Grants are funded through government revenues and hence do not follow strict rules of compliance, reporting, and accountability requirements. These usually come with specified purposes because the government grants them for a certain type of business or towards a specific field such as scientific research, rural development, renewable energy, or targeting women or minorities, among others.

| Grant Program | Description | Use / Benefits |

| STEM Workforce Grants (Governor’s Office of Science, Innovation and Technology) | Supports the development of Nevada’s STEM workforce through business-led training or job placement programs. | Workforce development, apprenticeships, STEM education initiatives. |

| Grants.gov | Federal portal for business grants across various industries and departments. | R&D, rural development, education, and tech innovation. |

| National Association for the Self-Employed (NASE) | Offers growth grants of up to $4,000 to members. | Marketing, hiring, and purchasing business equipment. |

| Nevada Women’s Philanthropy (NWP) | Las Vegas-based nonprofit supporting women-led or women-serving organizations. | Business training, nonprofit development, women entrepreneur support. |

| Rural Energy for America Program (REAP) (USDA) | Offers grants and loan guarantees for energy efficiency and renewable energy. | Solar panels, energy-saving upgrades, clean tech investments. |

| Rural Relief Small Business Grant | Nonprofit-administered grant program for rural areas. | Day-to-day operations, COVID-19 recovery, continuity planning. |

| SBA Federal Grant Resources | SBA provides links and support for federal grant programs. | Innovation, export support, underserved community funding. |

| SBIR & STTR Programs | Competitive federal R&D grants for small, innovative businesses. | Technology development, prototyping, and research partnerships with universities. |

| Technical and Economic Assistance Program (TEAP) | Nevada-specific support for technical assistance and market research. | Business development planning, feasibility studies. |

Table 1: Nevada Grant Sources types (Source: Self-Created)

Nevada Business Incentives

Apart from grants, Nevada offers a versatile and wide range of incentive programs that comprise tax credits and rate reductions, property inducements, and various supporting initiatives to encourage and sustain business within the state. These are controlled through the Governor’s Office of Economic Development (GOED) and they have an impact in cutting the expenses of doing business.

| Incentive | Description | Benefit to Business |

| Sales and Use Tax Abatement | Tax breaks on capital equipment purchases. | Lower upfront costs for machinery, tools, or infrastructure. |

| Sales and Use Tax Deferral | Delays tax payments on certain business expenses. | Improves early-stage business cash flow. |

| Modified Business Tax Abatement | Reduced payroll tax burden. | Cost savings when hiring or expanding workforce. |

| Personal Property Tax Abatement | Tax breaks for businesses meeting economic development goals. | Encourages job creation and capital investment. |

| Real Property Tax Abatement (Recycling) | Incentives for businesses investing in recycling and sustainability. | Promotes green operations and waste reduction. |

| Employee Training Grants | Funding support for onboarding or upskilling staff. | Reduces training costs, and improves workforce readiness. |

Table 2: Nevada Business Incentives (Source: Self-Created)

Foreign Trade Zones (FTZs)

Foreign Trade Zones are available for the Northern and Southern Nevada business entities involved in import and export operations. FTZs are particularly beneficial to those companies that need to store their inventory before putting them through the production line, testing, repackaging, or servicing before exporting or selling them domestically in Nevada.

| Location | Benefits | Ideal For |

| Northern Nevada FTZ | Deferred/reduced import duties, easier customs processing. | Import/export businesses, manufacturers, distributors. |

| Southern Nevada FTZ | Lower tariffs, and global logistics advantages. | Companies importing raw materials or assembling for export. |

Table 3: Foreign Trade Zones (FTZs) in Nevada (Source: Self-Created)

3. Angel Investors and Venture Capital in Nevada

For high-growth ventures, especially in technology, health, and energy, Angel investors and Venture capital are probably the most efficient ways of financing rapid growth. Apart from the capital itself, they offer support in terms of experienced business advice and connections and contacts to other businesses.

| Category | Name | Location | Focus Area | Description |

| Angel Investors | Sierra Angels | Incline Village | Early-stage tech and innovation startups | One of Nevada’s oldest angel groups, investing in Northern Nevada and nearby California. |

| Las Vegas Angel Conference | Las Vegas | General startups, pitch-based competition | A pitch event connecting Nevada startups with accredited investors. | |

| Vegas Valley Angels | Las Vegas | Tech, healthcare, and consumer products | Actively invests in Southern Nevada startups, offering capital and mentorship. | |

| Venture Capital Firms | StartUpNV / FundNV | Statewide | Seed-stage startups, all industries | Nevada’s startup incubator offering mentoring, pre-seed and seed-stage investments. |

| Battle Born Venture | Statewide | High-growth, early-stage businesses | State-run VC program by GOED that co-invests with private capital in Nevada startups. | |

| Audacity Ventures | Regional (invests in NV) | Tech and disruptive innovation | Not Nevada-based, but has shown interest in supporting scalable startups in the region. | |

| Revolution Ventures | National (includes NV) | Consumer tech, logistics, and innovation | National VC firm that considers Nevada-based startups with strong growth models. |

Table 4: Angel Investors and Venture Capital Firms in Nevada (Source: Self-Created)

All in all, both angel investors and venture capital firms present important channels for financing for growing firms in Nevada. It makes equity investment more appealing for the following reasons as a form of financing, especially for ambitious business owners willing to grow big and compete across national or international markets. As the infrastructure of the startup sector in Nevada progresses, more equity investment offers will become available and sophisticated, adding to the growing fortunes of the state’s business sector.

4. Crowdfunding and Alternative Financing

Nevada startups can consider the use of new and innovative sources of funding to improve their funding strategies. They include Crowdfunding, Equity crowdfunding, Peer to peer lending, which enable the sourcing of capital while at the same time trying to create publicity for the business.

1. Crowdfunding Platforms

It is a financing technique that enables the usage of small money from a large number of people through the use of online tools. It is especially useful for creative or product-based businesses and maybe a type of funding and a marketing strategy at once. Starting with crowdfunding depends on a good narrative, quality pitch, and sustained advertisement through integrated social media and one’s networks.

| Platform | Best For | Aspects |

| Kickstarter | Creative projects, tech gadgets, and consumer products | Reward-based, highly public campaigns. |

| Indiegogo | Product development, tech innovation, and flexible funding | Flexible funding options; suitable for various business types |

| GoFundMe | Community-based or socially impactful businesses | Donation-based; ideal for businesses with a social mission |

Table 5: Nevada Crowdfunding Platforms/ (Source: Self-Created)

2. Equity Crowdfunding

Traditional crowdfunding ensures contributing and receiving several products or other benefits, equity crowdfunding allows customers to invest in the business and become its shareholders. This type of funding is suitable for those young companies that want to launch relatively large financing campaigns and attract investors’ attention for the long term. Equity crowdfunding is under the regulation of the SEC and utilises legal documents and disclosures, it is a good way to replace traditional venture capital for some kinds of businesses.

| Platform | Best For | Aspects |

| SeedInvest | High-growth startups seeking accredited investors | Strict vetting process; connects with VCs and accredited investors |

| Wefunder | Startups looking for accessible investment options | Allows non-accredited investors; strong community support |

| Republic | Diverse startups including tech, gaming, and sustainability | Broad investor base; SEC-compliant and startup-friendly |

Table 6: Equity Crowdfunding Platforms (Source: Self-Created)

3. Peer-to-peer (P2P) Lending and Fintech Financing

Peer-to-business financing matches the borrowers including small business persons with individual or institutional financiers on the Internet. They are usually more friendly in their loan terms as well as a quicker process in approving loans as compared to credit given by banks.

| Platform | Best For | Aspects |

| LendingClub | Small businesses needing personal or business loans | Evaluates financial health to offer business loans |

| Prosper | Personal loans for entrepreneurs | Peer-to-peer lending with set interest rates |

| Funding Circle | Established SMEs needing business loans | Competitive interest rates and larger loan amounts |

| Kabbage | Businesses needing flexible lines of credit | Uses real-time performance data for quick approvals |

| BlueVine | Working capital loans and invoice factoring | Ideal for managing cash flow and short-term needs |

| OnDeck | Fast access to capital based on business performance | Quick algorithm-based approval process |

Table 7: Peer-to-Peer (P2P) Lending and Fintech Solutions in Nevada (Source: Self-Created)

5. How to Improve Your Chances of Securing Funding

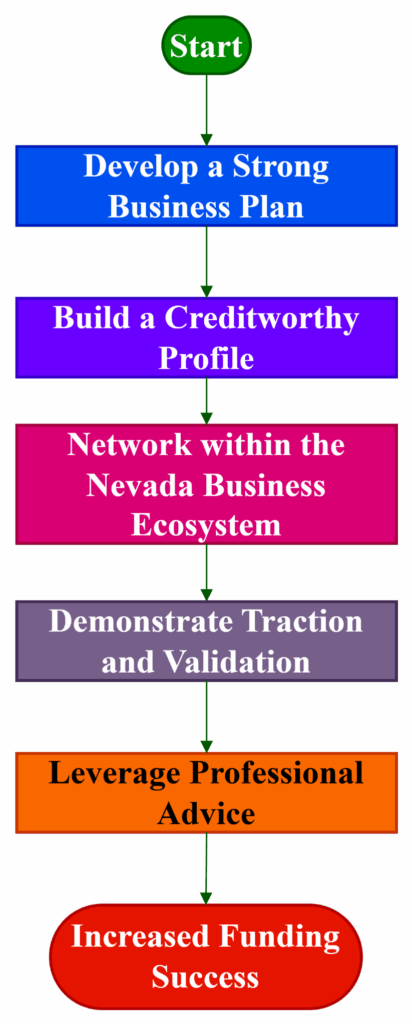

The following is a strategic guide that would increase the possibilities for small businesses to access capital in Nevada. To begin with, they need to prepare a clear business plan that should outline the choice of a business model, the chosen market segment and market share, and the expected revenues and expenses. It is also important that an individual has a good credit standing as well as good habits when it comes to financial management. The connections are strengthened by participation in networking events and startup incubators that exist in the network of business opportunities in Nevada. The next step is evaluating trends to illustrate that the product is getting market adoption through initial sales and word of mouth. Lastly, consulting with tutors, financial consultants or lawyers is very essential to prepare well for the application and presentation. The implementation of these guidelines goes a long way in enhancing the possibility of the startup garnering funding and growing to the next level. The figure below shows the process for improving the chances of the businesspersons in Nevada to secure funding.

Figure 1: Securing Funding Process (Source: Self-Created)

6. Conclusion

In relation to funding, Nevada provides a favorable and diverse environment for any new business. From government grants, microloans, angel investors, venture capital, crowdfunded, and even other alternative loans, the risk-takers have lots of means through which they can get ready cash at different times and in different businesses. Getting funding for a venture is not determined by the type of funding received but also by the level of preparedness of the entrepreneur and how adequately prepared they are to pitch their idea. Having a good strategy, connections, and type of attitude, starting and developing a business in Nevada is easier than ever. Whether it is traditional or non-traditional financing methods, it is essential to identify and choose the best financing model for a start-up company.

Leave a Reply