1. Introduction

Nevada has benefits for business corporations to start their business in this state. The state does not have corporate income tax and no personal income tax is imposed on the citizens of this state. It equally protects the privacy of business owners to the about level. This report will help an entrepreneur to guide them in the formation of a corporation. It also provides the procedure, legal charges, and compliance aspects. Last of all, it provides the positive aspects and the negative aspects of forming a corporation in Nevada.

2. Why Form a Corporation in Nevada?

Nevada offers various advantages for business, thus being one of the most suitable states for incorporation. There is no state corporate income tax, personal income tax or franchise tax in Texas, which decreases the financial pressures. The laws protecting business ownership make sure that information cannot be leaked. The state provides the directors and officers with strong legal shields against liabilities. Furthermore, it grants the ease of incorporation through the services of expediting and does not have a specified minimum capital. These are some of the reasons why the region is suitable for business-minded persons and companies [Refer to Table below].

| Advantage | Description |

| No State Corporate Income Tax | Nevada does not levy a state-level corporate income tax, reducing tax burdens. |

| No Franchise Tax | Unlike many states, Nevada does not impose franchise taxes. |

| No Personal Income Tax | Business owners benefit from no state personal income tax. |

| No Inheritance Tax | Businesses with complex ownership structures avoid inheritance tax liabilities. |

| Asset Protection | Robust laws shield personal assets from business liabilities. |

| Privacy | Business owners can keep names and information confidential in corporate records. |

| Streamlined Corporate Formation | The corporate formation process is straightforward and efficient. |

| Proximity to Major Markets | Close to key markets like California, Arizona, and Utah. |

| Flexibility | LLCs have flexible structures and tax treatment options. |

| Low Cost of Doing Business | Nevada has a lower cost of doing business than the national average. |

Table 1: Advantages of Starting a Corporation in Nevada (Source: Self-Created)

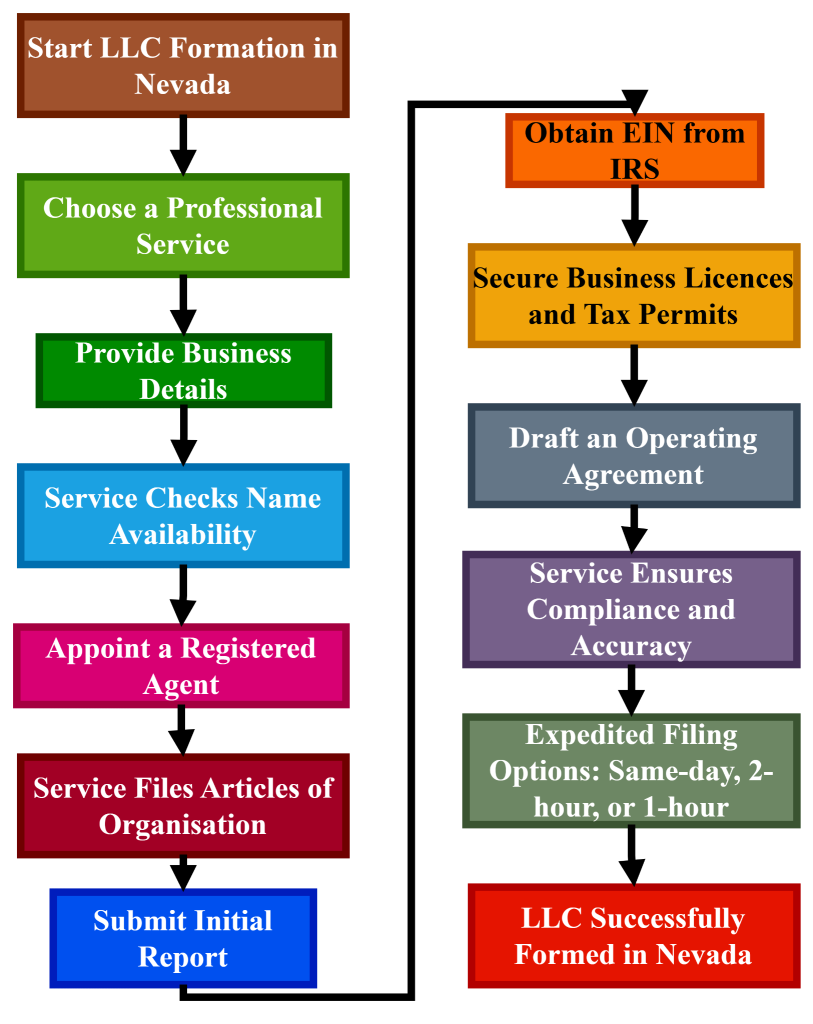

3. Step-by-Step Guide to Forming a Corporation in Nevada

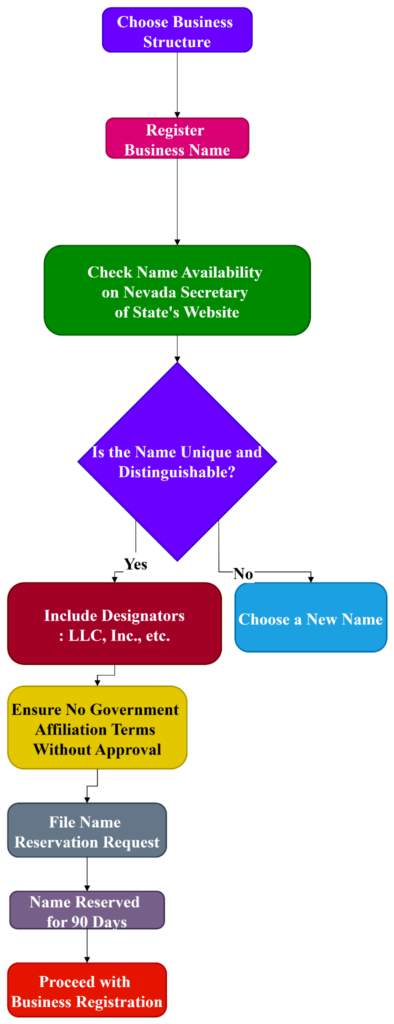

Business incorporation in Nevada is a complex process that involves proper organisational planning, attentiveness to legal formalities and compliance with the laws of the state. While registering a corporate business entity, there are certain legal formalities that an entrepreneur has to go through apart from ensuring that the business entity is legally operational in every aspect. This section is a comprehensive guide on how to start a business in Nevada by providing information on the business name, the process of filing, and taxes, among others. The following table outlines the step-by-step procedure of how to incorporate a corporation in Nevada.

| Step | Details | Key Considerations |

| 1. Choosing a Corporate Name | Selecting a unique name not already in use. Ensuring the name includes “Corporation,” “Incorporated,” “Corp,” “Inc.,” or “Co.” Conducting a name search with the Nevada Secretary of State. | Complying with Nevada’s naming rules. Reserving the name if required. |

| 2. Appointing a Registered Agent | Designating a registered agent to receive legal and tax documents. Provide a physical Nevada address (not a PO Box). Ensuring availability during business hours. | Acting as the agent, appointing an employee, or hiring a registered agent service. |

| 3. Filing Articles of Incorporation | Submitting Articles of Incorporation to the Nevada Secretary of State. Including the business name, registered agent, authorised shares, and purpose. Filing online, by post, or in person. | Paying applicable filing fees. Using expedited processing if needed. |

| 4. Preparing Corporate Bylaws | Establishing internal rules for business operations. Defining roles and responsibilities of shareholders, directors, and officers. Adopting bylaws through the board of directors. | Structuring governance effectively. Keeping by laws updated. |

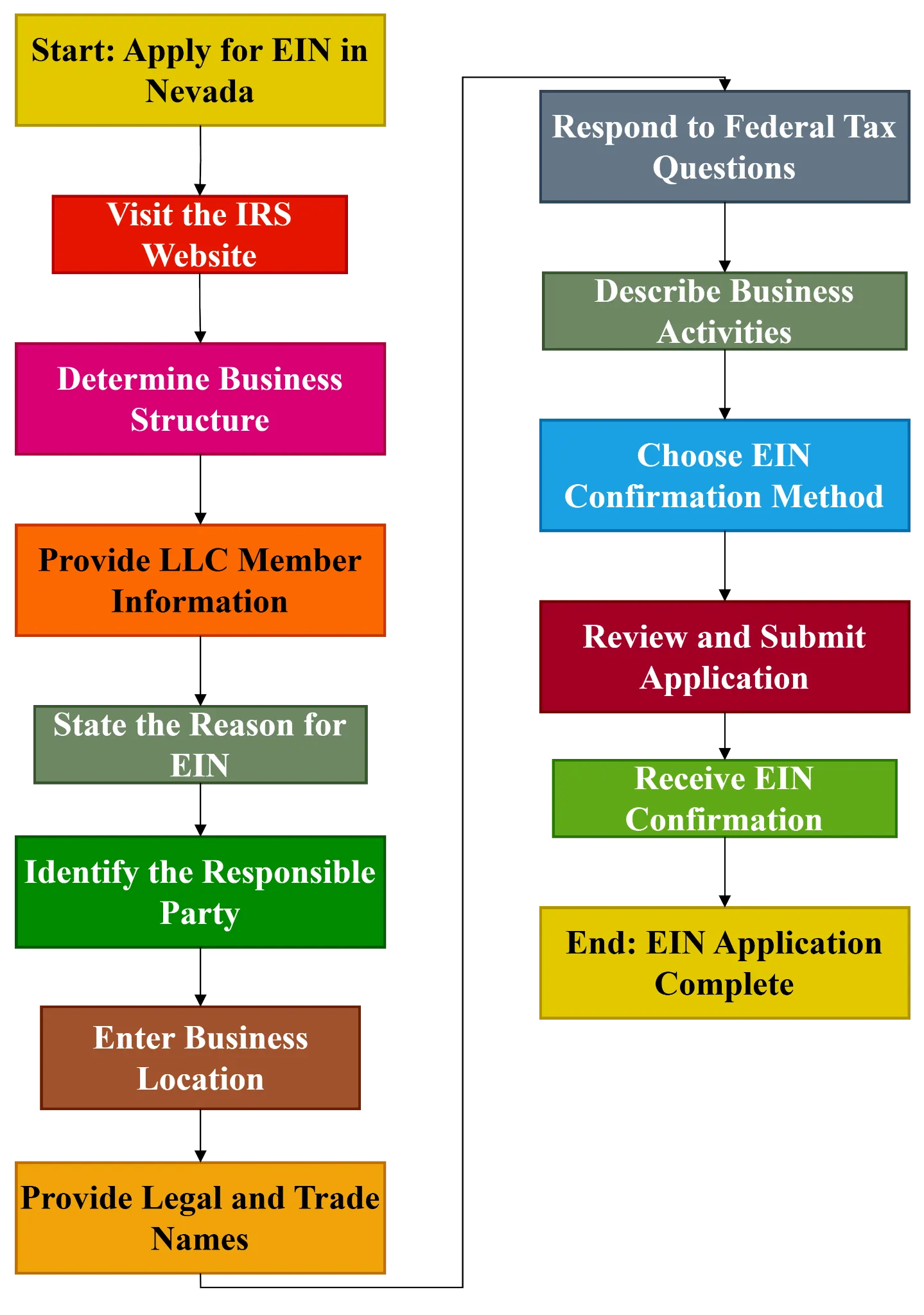

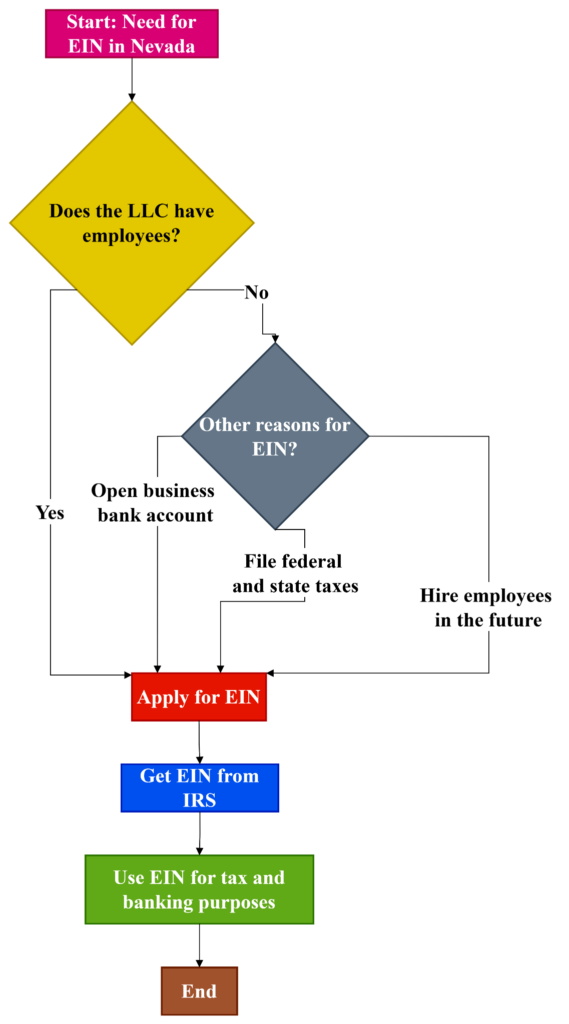

| 5. Obtaining an Employer Identification Number (EIN) | Applying for an EIN through the IRS for tax filing and hiring employees. Using EIN to open a corporate bank account. | Ensuring EIN matches the legal name. Keeping EIN secure. |

| 6. Complying with Tax Requirements | Registering for necessary state and local taxes. Obtaining permits and licences for certain industries. Meeting Nevada tax regulations. | Checking obligations with the Nevada Department of Taxation. Avoiding penalties for non-compliance. |

| 7. Taking Additional Steps (Optional but Recommended) | Drafting a shareholder agreement to define ownership and responsibilities. Holding an organisational meeting to elect officers and approve bylaws. Opening a corporate bank account. Obtaining business licences and permits. Filing the Beneficial Ownership Information Report with FinCEN. | Strengthening corporate credibility. Meeting legal and banking requirements. |

Table 2: Steps for Corporation Formation in Nevada (Source: Self-Created)

4. Nevada Corporation Filing Fees and Costs

When forming a corporation in Nevada, several fees are mandatory to be paid. The total amount of incorporation expense at the start is $725 which a $75 for filing of Articles of Incorporation, $150 for the Initial List of Officers and Directors, and state business of $500 licence fee. Moreover, it is crucial to mention that a business might need a registered agent service, which tends to start from $100 and costs up to $300 a year. As for other services like expedited processing, there are additional costs associated with this service. In order to adhere to the corporation’s law, a business needs to make sure it renews its licence as well as the Annual List of Officers and Directors which costs the company annual fees. Since fees are subject to change, it is advisable to verify the information from the website of the Nevada Secretary of State [Refer to Table below].

| Fee Type | Cost (USD) | Details |

| Articles of Incorporation Filing Fee | $75+ | The fee starts at $75 and varies based on the number of authorized shares. |

| Initial List of Officers and Directors | $150 | Must be filed within 30 days of incorporation. |

| State Business License Fee | $500 | Required annually for all corporations. |

| Registered Agent Fee | $100–$300 | Varies depending on the service provider. |

| Expedited Processing Fees | Varies | Optional service for faster filing. |

| Annual List of Officers and Directors | $150 | Due every year to maintain compliance. |

| Business License Renewal Fee | $500 | Must be renewed annually to remain in good standing. |

Table 3: Nevada Corporation Filing Fees and Costs (Source: Self-Created)

5. Maintaining Compliance as a Corporation

Business entities operating in Nevada face certain legal necessitates covering compliance laws in the state. The company must file an annual list of officers and directors. This will help the state to have updated records of corporate governance. This may either attract penalties or result in dissolution in case of failure to file within the required time. Another mandatory procedure is to renew the state business licence in Nevada. Every corporation needs to have its operating legitimacy by paying an annual business licence fee. Maintaining records of a corporation’s affairs is very important to ensure that the operations of the corporation are well explained and protected legally. A firm also needs to record shareholders’ meetings, the board of directors’ resolutions and decisions, and financial operations. It is important to have a resident agent in Nevada to accept official documents.

6. Pros and Cons of Forming a Corporation in Nevada

Pros of Forming a Corporation in Nevada

A clear benefit of forming a corporation in Nevada is the corporate taxation policy. Unlike other states, the state does not levy corporate income tax, personal income tax or franchise tax to make the overhead costs low. Another advantage of Nevada is a high level of protection of personal information; in particular, the names of the company’s owners and shareholders are non-disclosed. This makes it suitable for business people who wish to keep their companies’ structures unknown to the public. Other advantages include limited liability of the directors, officers, and shareholders whereby an individual’s property cannot be seized to respond to business obligations or lawsuits.

The process of incorporation is relatively fast and the companies can even choose a faster incorporation process as an option in cases where they need to start a business right away. Such friendly business policies enable efficiency of the company’s management and decision-making making it easier to conduct business in the State. Since there is no state-level audit, the companies have adopted a less rigorous process to prepare and report their financial statements thus minimising the administrative burdens.

Cons of Forming a Corporation in Nevada

Forming a corporation in Nevada also has some disadvantages. A few industries necessitate the disclosure of ownership and consequently, eradicating the confidentiality that comes with Nevada corporations. When it comes to legal liability directors and officers are protected, however, they remain vulnerable to legal action that could cost them a lot of money to defend themselves. Although the incorporation process is quite smooth in Nevada, the filing charges and other compliance costs are slightly higher than those of other states. Despite no restrictions on minimum capital to engage in business in Nevada, there are challenges that businesses, especially those with limited capital, will face in the course of rapid growth. States today have many compliance and reporting standards and procedures to follow which take much administrative work and make operation more complicated. Business organisations are also required to register in other states apart from Nevada thus incurring more expenses and bureaucratic measures. The following table offers a concise and systematic view of the pros and cons of forming a business in Nevada, which may help business people in their decision-making process.

| Aspect | Pros | Cons |

| Tax Benefits | No state corporate income, personal income, or franchise tax, reducing financial burden. | Businesses operating outside Nevada may still be subject to other states’ taxes. |

| Privacy Protection | Ownership details and shareholder information are not publicly disclosed. | Some financial institutions may require ownership disclosure for business accounts. |

| Liability Protection | Directors, officers, and shareholders have strong legal protection from personal liability. | Lawsuits can still affect corporations, requiring legal expenses for defence. |

| Ease of Incorporation | Fast and efficient filing process with expedited options available. | Filing fees and ongoing compliance costs may be higher than in other states. |

| No Minimum Capital Requirement | Corporations can be formed with little to no initial investment. | Limited capital can affect a business’s ability to scale operations. |

| Business-Friendly Regulations | Nevada has flexible corporate laws that support management and decision-making. | Strict compliance and reporting obligations require constant administrative effort. |

| Annual Costs | Competitive business costs compared to states with higher taxation. | Business license fees and registered agent costs add to expenses. |

| Corporate Flexibility | No residency requirements for directors, allowing international business ownership. | Operating outside Nevada may require registering in additional states, increasing costs. |

| No State-Level Audits | The state does not impose corporate audits, simplifying financial reporting. | Federal audits and compliance requirements still apply for tax reporting. |

| Strategic Location | Proximity to major markets like California, Arizona, and Utah. | Limited economic diversity compared to larger business hubs like New York. |

Table 4: Advantages and Disadvantages of Forming a Corporation in Nevada(Source: Self-Created)

7. Conclusion

The Nevada Corporations law states that corporations should make and keep records of actions that are important to their business. In the case of business, it is important to keep proper records since the financial data is used in auditing, to attract investors and even to manage the business. Record keeping is also crucial in organisations so that they can be able to seek funds and future capital. Any breach of its laws attracts fines or dissolution because the state of Nevada will not hesitate to enforce the law. It is crucial to fulfil all the legal requirements in sustaining a successful business in the long run. Thus, Nevada state would benefit corporations in areas of tax policy, litigation protection, and confidentiality.