1. Introduction

Many people choose to form an LLC in Nevada because of its business-friendly policies, favourable taxes, and strong privacy regulations. Because of these benefits, lots of entrepreneurs are attracted to Nevada. If steps in the process are not completed properly, it can cause delays, charges, or legal dangers for startup business owners. This guideline discusses some common errors when forming an LLC in Nevada and provides a way to avoid them. The aim is to help entrepreneurs, business consultants, and investors become aware of these risks so they know how to start and run their LLCS properly. The report’s organisation covers common points where mistakes often happen. The structure of the report includes key areas where errors frequently occur while selecting the business structure and getting the name registered. The Nevada business owners can also face consequences while handling the documents, complying with legal requirements, and implementing preventive actions.

2. Choosing the Wrong Business Structure

When starting a business in Nevada, choosing the best business structure is one of the most vital decisions for an entrepreneur. While an LLC is usually a good choice because it protects business owners’ assets and can help with taxes, it might not be the answer for every type of business. Some create an LLC without recognising why existing forms of business are different from an LLC. A lack of understanding may lead to missing out on tax benefits and facing extra legal problems. For instance, an LLC might not have some of the same financial benefits as a C-Corp, especially if a business wants to apply for venture capital funds. It is very common for business owners to skip going to experts before they get their company started. The table below lists some things one should keep in mind when picking a business structure for an LLC business in Nevada.

| Category | Key Points To be Considered |

| Liability | LLCS provide limited liability protection, shielding personal assets from business debts. However, improper actions or breaches can still result in liability. |

| Taxes | LLCS are pass-through entities for tax purposes, avoiding double taxation. Nevada has no state income tax This feature provides added advantages. |

| Flexibility | LLCS offer flexible management and ownership options Accommodating a variety of operational models and member roles. |

| Complexity | Though simpler than corporations, LLCS still require compliance with legal filings, tax rules, and ongoing documentation. |

| Raising Capital | Nevada startup LLCs might have a harder time getting investors interested, since corporations are often seen as a safer bet by most people. This can make it hard for a company to give out parts of the business to others or to get new investments. |

| Business Needs | Structure should align with risk level, management preferences, and growth goals. Poor alignment can hinder long-term success. |

| Increased Personal Liability (Risk) | Choosing the wrong structure may not protect personal assets, exposing owners to financial risk in lawsuits or debts. |

| Tax Troubles (Risk) | A misaligned structure can result in higher taxes, missed deductions, or IRS penalties due to improper classification. |

| Limited Growth Potential (Risk) | Structures not suited for investment can limit capital raising and expansion opportunities. |

| Legal Complications (Risk) | An unsuitable structure can lead to disputes, compliance violations, or complex and costly restructuring efforts later. |

Table 1: Choosing the Right Business Structure for an LLC in Nevada (Source: Self-Created)

3. Mistakes with Business Name Selection in Nevada

People often make a mistake when starting an LLC in Nevada by choosing a name without really checking if it’s allowed or fits the rules, or by picking one they didn’t take enough time to research. Nevada’s LLC rules say that one cannot use a business name that is already being used by another company in the state. Many people starting a business in Nevada assume their business name is free just because they like it, but they forget to look it up in the state business records. As a result, missing this step can result in being turned down, delays, or possible legal clashes over a trademark infringement. In addition, certain business owners overlook the ways a name can influence their marketing and their brand. A generic name or one that sounds just like other companies can obtain a negative response from customers and stop commercial efforts from being successful.

| Mistake | Nevada-Specific Requirement | Potential Consequence | Recommended Solution |

| Assuming the name is available | The name must be distinguishable from all registered businesses listed with the Nevada Secretary of State. | This caused the rejection of the Articles of Organisation and necessitated refiling with a new name. | Conducting a name availability search using Nevada’s Business Name Search Tool before filing. |

| Omitting the required suffix | Mandating the use of a business identifier such as “LLC” or “L.L.C.” in the official business name. | Leading to a filing rejection due to non-compliance with state naming rules. | Including the appropriate legal suffix in the business name before submission. |

| Using a name too similar to another | Prohibiting names that are deceptively similar to existing businesses registered in Nevada. | Risking legal action, brand confusion, or forced renaming. | Selecting a unique and clearly distinguishable name and comparing it against existing entities. |

| Overlooking trademark conflicts | Not cross-checking with federal or common law trademarks, which Nevada does not automatically verify. | Resulting in infringement claims, cease-and-desist letters, or rebranding costs. | Performing a comprehensive trademark search via the USPTO and legal databases. |

| Ignoring branding and memorability | While not a legal issue, weak or generic names can undermine marketability and customer recall. | Hindering brand development and limiting audience engagement. | Choosing a memorable, brand-aligned name that resonates with target customers. |

| Forgetting to secure digital assets | It is not required by law, but it is critical for digital presence and business identity. | Creating issues with brand consistency, losing out on domains or social profiles. | Securing the matching domain name and social media handles during the naming process. |

Table 2: Mistakes with Business Name Selection for Nevada LLC Formation (Source: Self-Created)

4. Errors in Filing Articles of Organisation

Filing the Articles of Organisation with the Nevada Secretary of State is necessary to legally set up an LLC. Still, many entrepreneurs tend to make mistakes that could be avoided in this area. Often, errors occur due to incorrect or incomplete details being included in the registration paperwork. This includes not getting the registered agent’s name right, putting down the wrong business address, or forgetting a few important signatures. Such errors can cause things to take longer, lead to legal problems, or even send the application back or reject it. In addition to problems with the content, businessmen often make mistakes with the state’s business procedures. Certain business owners either submit their filing forms late or use previous tax forms. Overlooking them might make the LLC owners subject to penalties or a rejection of the application. It is recommended that entrepreneurs cross-check all paperwork, check the exact requirements for their state, and reach out to a business formation expert or attorney when they need help. For more details, refer to Table 3 below.

| Common Error | How to Avoid It | Consequences of Error | Steps to Fix It |

| Incorrect LLC Name | Ensuring the name is unique and includes the appropriate suffix (e.g., LLC, L.L.C.). Conducting a name search on the Nevada Secretary of State’s website. | Filing may be rejected. The name conflicts with existing businesses. | Choosing a new name and refile, amend documents if already submitted. |

| Missing or Incorrect Information | Double-check all required fields, including name, address, management structure, and member details. Cross-reference with NRS 86 requirements. | Filing may be rejected, resulting in operational delays and future legal complications. | Filing a Certificate of Correction or Amended Articles of Organisation, depending on the severity of the error. |

| Improper Registered Agent or Office | Appointing a valid registered agent with a physical address in Nevada. Ensure availability during business hours. | Rejection of filing, risk of non-compliance, and inability to receive legal documents. | Updating the registered agent or office by filing the appropriate form with the Secretary of State. |

| Failure to Meet State-Specific Requirements | Reviewing Nevada’s formation checklist Including the Initial List of Managers/Members and business license. | Filing may be incomplete or invalid Delayed business registration. | Submit missing documents promptly or consult legal counsel regarding the next steps. |

| Incorrect Filing Fees | Referring to the Nevada Secretary of State’s website for current fee schedules Ensure that payment accompanies the submission properly as per Nevada’s law. | Rejection of filing. Unnecessary delays due to incomplete payment. | Resubmitting with correct fees; monitor for confirmation from the state office. |

| Failure to Sign the Document | Reviewing the Articles of Organisation to ensure they are signed by the authorised person(s) before submission. | Filing will be rejected. Business formation is delayed until corrected. | Adding proper signatures and resubmitting the corrected form. |

Table 3: Errors in Filing Articles of Organisation for a Nevada LLC (Source: Self-Created)

5. Failing to Maintain Compliance and Reporting

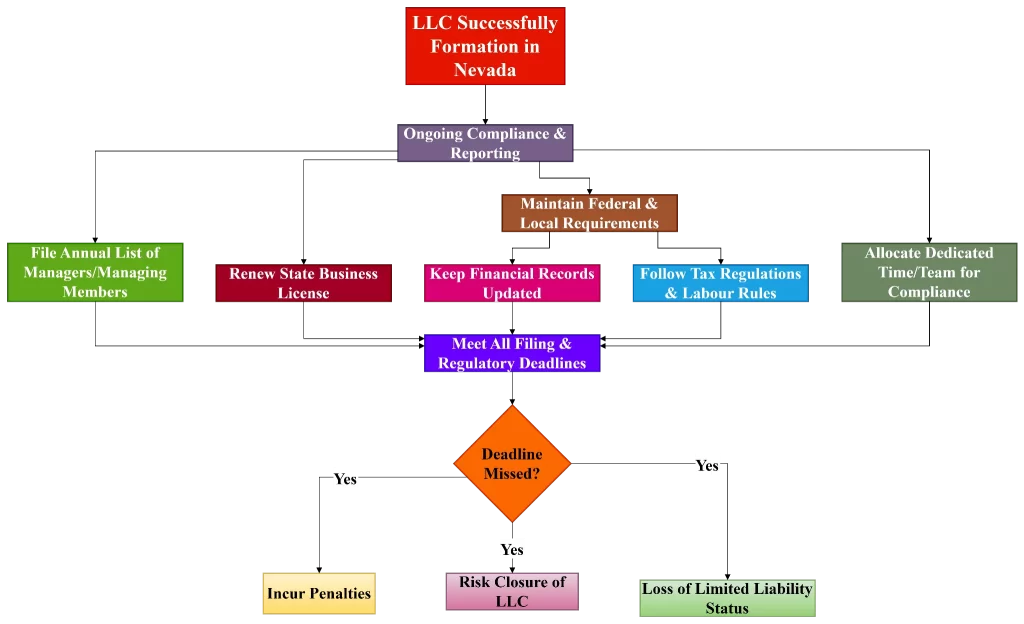

Once the LLC has been successfully formed, the responsibility to maintain a good reputation, along with taking good legal measures, does not end. Failing to meet the ongoing requirements for operating an LLC is one of the biggest errors business owners can make. As part of this, in Nevada, the Annual List of Managers or Managing Members has to be filed, and the State Business License has to be renewed each year. Failing to meet deadlines may carry penalties. It can also lead to the closure of the LLC or result in legal action against its members for limited liability status. Besides following Nevada state regulations, both federal and local requirements have to be met as well. Businesses are also required to keep their financial information up-to-date. They must surely follow tax regulations and obey the rules for labour in Nevada. A lot of business owners overlook the amount of time it takes to stay compliant, especially if they are not working with a dedicated team or schedule.

Figure 1: Nevada LLC Formation to Key Compliance Areas (Source: Self-Created)

6. Tips to Avoid Costly Errors from the Start

Avoiding these common pitfalls starts by consulting with people who are trusted and have experience in this field when forming an LLC in Nevada. Nevada’s LLC Enterprises must strictly follow the legal rules while forming an LLC in their state. It is advised that they should avoid seeking help through online advice. It is further recommended that they hire a good business attorney to address LLC-related issues. Seeking help from the registered agent of Nevada can clearly explain business-related work. They can also help in providing a legal business name in Nevada. The main advantage of this registered agent is that all the legal-related paperwork will be done properly and submitted before the deadline.

It is also important to set up check-ins and methods to keep track of any changes in Nevada’s rules or laws as they happen. Owners should try to keep track of important dates, make copies of important documents, and check if any laws in Nevada have changed. Accounting software, some basic tips on what tasks to prioritise, or getting help from someone part-time, can all make it easier to manage business finances. Staying up to date with new laws and rules makes it easier to avoid problems with the law.

7. Conclusion

When a company is organised as an LLC in Nevada, the owners can expect easy taxation, personal belongings are protected, and their data stays confidential. Unfortunately, even a few small mistakes during launch and the first phase can take away all the gains made from designing and launching the craft. Selecting the wrong type of business structure, using the wrong name for the company, and filling out paperwork incorrectly can all lead to problems in forming an LLC in Nevada. Preparation regarding the Nevada laws, education on the rules, and following all the necessary steps can help business owners avoid problems when forming an LLC in Nevada.

Leave a Reply