1. Introduction

Real estate has been a way to make money, generate passive income and accumulate wealth over the long term. Choosing a state in which to form their real estate company can make or break its profitability and legal protection for savvy investors. Nevada has a particularly good reputation as the friendliest jurisdiction for business all around, especially for those in the business of real estate investors looking to form LLCs. They can safeguard investment from loss, reduce liability, and generally raise returns, as this report seeks to explore ways of utilising Nevada’s business environment as a tool for real estate investors using LLC creation. Some of the major areas shall be discussed in the report, such as why Nevada LLCs are special for real estate, asset protection benefits, very simple ways to establish a Nevada LLC, tax advantages and some common pitfalls to avoid.

2. Why Real Estate Investors Choose Nevada LLCs

a. Business-Friendly Legal Framework

Nevada has been among the top states for incorporation in business due to its business-friendly framework. The law in Nevada gives good legal precedents in favour of corporations, and that is a very good thing; the investor can predict what the law will do with a very high level of certainty. Nevada has specially crafted laws regulating how LLCs are formed and established, which brings in both businesspeople and real estate professionals to encourage the regulatory environment for LLCs.

b. No State Income Tax

Another of the best benefits of setting up an LLC in Nevada is that it’s a state that doesn’t charge state income tax. As a result, real estate investors will get to keep more of their rental profits and capital gains. Nevada saves a lot of money compared to California and New York, high tax states and the long-term savings opportunities are far higher if you manage more than a few properties or a significant portfolio.

c. Privacy and Anonymity

LLC owners enjoy a lot of privacy in Nevada. Unlike most states, Nevada does not require the disclosure of the members or managers of an LLC to show up in public records. The anonymity of the securitisation enables property investors who seek to remain anonymous to protect themselves from lawsuits, groundless claims and other undesirable solicitations.

d. Flexibility in Management Structure

Nevada LLCs have flexible management, which means the investors can choose between manager management and member management. This much flexibility is ideal for a real estate venture or a family investment venture, and can easily delegate registered roles and responsibilities as per the investment plan.

3. Asset Protection Benefits for Real Estate

Nevada LLCs provide excellent asset protection for real estate investors by creating a distinct statutory bar between business and personal assets. Renowned for investor-friendly legislation, Nevada enhances protection via laws such as the charging order limitation and permits sophisticated mechanisms such as Domestic Asset Protection Trusts (DAPTs). These characteristics make Nevada the preferred jurisdiction for protecting real estate property from lawsuits, creditors, and personal liability exposure. For more details, refer to Table 1 below.

| Benefit | Description | Legal Mechanism | Investor Advantage | Creditor Limitation | Risk Mitigation Strategy |

| Limited Liability | Shield the real estate business’s personal assets from claims related to the property held in the LLC. | LLC as a separate legal entity | Personal assets (e.g., home, savings) are not at risk in lawsuits. | Creditors can only target assets held by the LLC, not the member. | Maintaining corporate formalities and not co-mingling personal funds. |

| Charging Order Protection | Prevents creditors from seizing LLC assets or gaining management rights. | Nevada Revised Statutes §86.401 | Investors retain control over the property even during legal disputes. | Creditors receive distributions (if any) but do not have control of the property. | Avoiding voluntary distributions to limit creditor gains. |

| Domestic Asset Protection Trust (DAPT) | An extra protective layer is added by transferring LLC ownership into a DAPT. | Nevada’s DAPT legislation (NRS §166) | Harder for creditors to access trust-owned LLC interests. | Assets in the trust are shielded even after legal judgments. | Properly structure and fund the trust in compliance with state laws. |

| Separation of Ownership | Legally distinguishes real estate from personal assets. | Title held under LLC name | Clear division simplifies accounting and protects personal net worth. | Property cannot be pursued as personal collateral. | Using a dedicated LLC for each property to isolate risks. |

| Charging Order as Sole Remedy | Nevada restricts creditor remedies to charging orders only. | Exclusive remedy rule under NRS | Reduces pressure from aggressive creditor actions. | Creditors cannot force the sale or management change of LLC-held assets. | Avoiding jurisdictions that allow foreclosure or more aggressive remedies. |

| Enhanced Confidentiality | Nevada does not require disclosure of members/managers in public filings. | Privacy laws and limited disclosure | Keeps ownership private, reducing exposure to legal targeting. | Makes it harder for litigants to identify asset holders. | Using nominee services or registered agents for added privacy. |

Table 1: Asset Protection Benefits of Nevada LLCs for Real Estate Investors (Source: Self-Created)

4. Setting Up a Nevada LLC for Real Estate Investing

Navigating through the setup includes filling out several important steps, from LLC name to obtaining business licenses and creating a dedicated bank account. This section details how to set up a Nevada LLC for real estate investment, breaking the process down into steps to assist investors in maintaining compliance and long-term profitability [Refer to Table 2].

| Step | Action | Description | Legal Requirement | Estimated Cost | Investor Tip |

| 1 | Naming the LLC | Choosing a unique name that includes “LLC” or “Limited Liability Company” and is not already registered. | Must comply with Nevada naming rules | $0 (included in filing fee) | Using Nevada’s online business name search tool to check availability is crucial. |

| 2 | Appointing a Registered Agent | Designating an individual or service in Nevada to receive legal documents on behalf of the LLC. | Required by Nevada law | $100–$300/year (if using a service) | Hiring a professional agent enhances privacy and ensures proper documentation. |

| 3 | Filing Articles of Organisation | Submitting formation documents to the Secretary of State, including name, agent, and management structure. | Mandatory filing of the LLC form | $75-$150 + optional expedited fees | Filing online ensures quicker approval; verifying accuracy helps avoid delays. |

| 4 | Obtaining a State Business License | Securing and renewing the required license to legally operate the LLC in Nevada. | Mandatory for all LLCs | $200 annually | Marking annual renewal dates prevents late fees and keeps the LLC in good standing. |

| 5 | Drafting an Operating Agreement | Creating a document that outlines ownership structure, responsibilities, voting rights, and dissolution terms. | Not legally required, but highly advised | $0–$500 (if using a legal service) | Drafting an agreement is vital for clarity, especially with multiple investors. |

| 6 | Applying for an EIN | Registering for a Federal Employer Identification Number for tax and banking purposes. | Required for tax filings and bank accounts | Free (via IRS) | Applying online through the IRS is fast and ensures legitimacy for financial activity. |

| 7 | Opening a Business Bank Account | Establishing a separate financial identity for the LLC to maintain asset protection. | Needed to maintain liability protection | Varies by bank (often free) | Opening a dedicated account prevents co-mingling and supports clear recordkeeping. |

| 8 | Considering Foreign Qualification | Registering the Nevada LLC in another state if operating or owning property outside Nevada. | Required if transacting outside Nevada | $50–$300+ (varies by state) | Considering the benefits versus costs ensures informed decision-making. |

Table 2: Setting Up a Nevada LLC for the Real Estate Investing Process (Source: Self-Created)

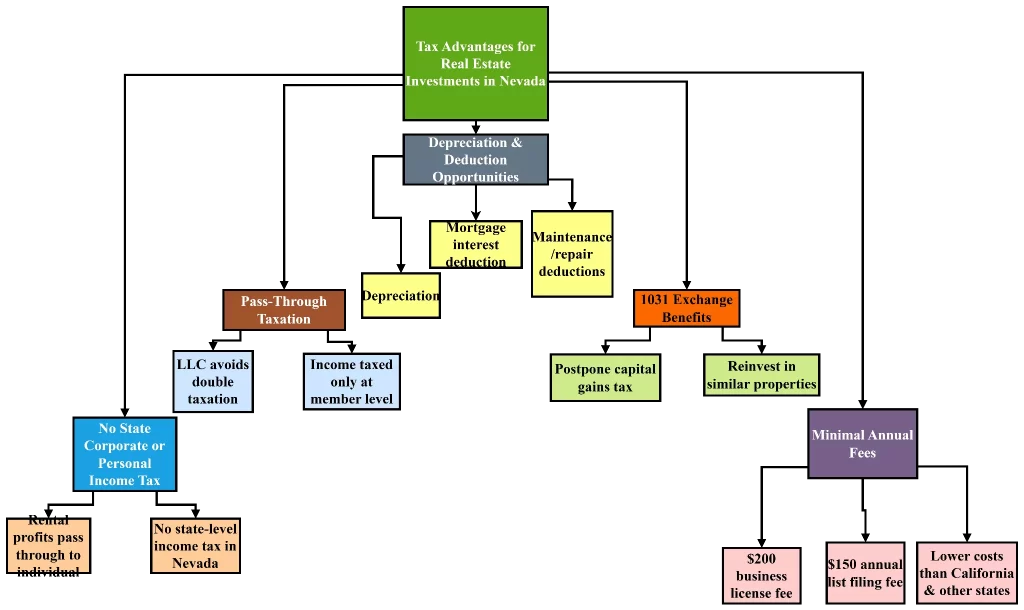

5. Tax Advantages for Real Estate Investments in Nevada

1. No State Corporate or Personal Income Tax

The absence of personal and corporate income tax is perhaps Nevada’s strongest tax benefit. Rental profit, appreciation, and other gains pass through the LLC to the individual investor without incurring state-level taxation, optimising profitability.

2. Pass-Through Taxation

Nevada LLCs enjoy pass-through taxation. This does not mean the LLC pays federal income tax. Rather, they pass through to members’ tax returns and avoid the “double taxation” seen in C-corporations and suit real estate ventures perfectly.

3. Depreciation and Dedication Opportunities

Investors are able to leverage federal tax benefits such as depreciation, mortgage interest deductions, and repairs/maintenance expense deductions. Combined with Nevada’s zero-tax system, these write-offs can significantly lower an investor’s taxable income.

4. 1031 Exchange Benefits

Though subject to federal regulations, the 1031 exchange is a technique of postponing capital gains taxation by reinvesting in similar properties, which complements Nevada’s design well. Investors utilising Nevada LLCs frequently use 1031 exchanges to expand their portfolios with less tax exposure.

5. Minimal Annual Fees

Relative to other such states as California, which charges huge yearly franchise taxes and minimum income taxes upon LLCs, Nevada’s annual expenses are modest. These are the $200 business license fee for the state and a list filing fee of $150 each year, thus keeping ongoing compliance within reach of small and large investors.

Figure 1: Tax Advantages for Real Estate Investments in Nevada (Source: Self-Created)

6. Common Real Estate LLC Mistakes in Nevada and How to Avoid Them

| Sr. No. | Mistake | Description | How to Avoid | Why It Matters | Best Practice Tip |

| 1 | Lacking a Clear Real Estate Investment Plan | Starting a Nevada real estate LLC without defined goals, a budget, or property strategies. | Creating a detailed investment roadmap for property types, financing, and timelines. | Ensures strategic property selection and reduces costly missteps. | Reviewing the plan quarterly to adapt to Nevada’s evolving market. |

| 2 | Skipping Market Research in Nevada | Ignoring local real estate trends, zoning laws, and regional development plans. | Researching Nevada-specific property data, laws, and forecasts. | Prevents poor investment choices and legal setbacks. | Subscribing to Nevada real estate journals and city planning updates. |

| 3 | Going Solo Without Nevada-Based Experts | Managing Nevada property deals without legal, tax, or real estate professionals. | Partnering with experienced local attorneys, CPAs, and advisors. | Enhances decision-making and reduces regulatory risk. | Building a Nevada-based advisory team early in the process. |

| 4 | Choosing the Wrong LLC Structure for Real Estate | Selecting an LLC model that doesn’t match Nevada real estate goals. | Consulting professionals on whether a single-member, multi-member, or series LLC is best. | Impacts tax efficiency and legal compliance. | Reassessing the structure annually based on portfolio growth. |

| 5 | Misclassifying Nevada LLC for Tax Purposes | Applying an unsuitable tax status to Nevada real estate LLC. | Consulting with a tax expert to select the correct classification (e.g., S Corp). | Helps avoid tax penalties and maximises returns. | Filing IRS forms (e.g., 2553) promptly with accurate details. |

| 6 | Neglecting the Operating Agreement for Property Ventures | Not drafting or updating a clear agreement among LLC members. | Creating a formal operating agreement defining roles, property rules, and exit terms. | Reduces internal disputes and protects real estate assets. | Including real estate-specific clauses like buyouts or co-investments. |

| 7 | Neglecting Financial Recordkeeping for Properties | Failing to track LLC property income, maintenance costs, and taxes. | Maintaining clean, updated financial records for each Nevada property. | Supports tax filing, audits, and profit assessment. | Using property management software tailored to Nevada rules. |

Table 3: Common Real Estate LLC Mistakes and Mitigation Strategy (Source: Self-Created)

7. Conclusion

As a real estate investor, I believe Nevada’s combination of tax advantages, legal safeguards, business anonymity, and accommodating LLC options is the best in the country. A Nevada LLC can be a great tool for such investors because it can protect personal assets and ultimately optimise profits by leveraging pass-through taxation in addition to no state income tax. The benefits of LLCs, however, do not become apparent unless you’re clever at creating and sustaining one. However, it is equally important to realise whether Nevada is, in fact, the right real estate investment location and according to what objectives. This gives real estate agents confidence to create and protect a portfolio in a competitive market.

Leave a Reply