1.0 Overview of Nevada’s Privacy and Confidentiality Laws

The privacy of business formation is one of the ways to secure owners from identity theft and harassment. Nevada is very popular for its good legal protection and business privacy. The state has created favourable laws that protect the LLC owners from exposure. Unlike most other jurisdictions, Nevada does not have a requirement involving disclosure of public ownership. Registered Agent’s contact information is the only information included in the Articles of Organisation. Members and managers can be anonymous to the public in an LLC. This enables the entrepreneurs to engage in business without worrying about disclosing personal details. In addition, Nevada does not collect a Social Security number for LLC formation. This forms an environment which allows the person to operate with minimal personal risk. Such privacy policies make Nevada a favourable destination for investors, startups, and consultants.

Nevada also provides for flexibility with nominee officer and director arrangements. Such arrangements enable third parties to appear on public filings in place. Owners can privately run operations yet within the safety of legal structures. This report seeks to discuss how Nevada’s legal arrangement supports privacy for the LLC owners. It describes some of the main confidentiality safety measures, compares Nevada with other privacy-oriented states such as Delaware and Wyoming, and describes how to maximise anonymity. The report also discusses limitations and legal safeguards that ensure the privacy of one’s personal and financial life within the corporate life of Nevada.

2.0 How Nevada Protects Your Personal Information

The Nevada LLC framework is beneficial for owners who prefer security and legal measures. Names do not have to be revealed in the official Articles of Organisation by the LLC owners in Nevada. Just the address of the Registered Agent is sufficient in the public business record. This makes the Registered Agent act as a privacy shield for the owners. Their function protects people from businesses’ databases and search engines. Nevada permits nominee members or company managers. These nominees can be seen in public filings, and the real owners remain hidden. Legal agreements make it impossible for nominees to run operations and financial affairs. This maintains the ownership details private and within the legal provisions of Nevada. The absence of public databases adds to the privacy of corporate filings. Unlike some other jurisdictions, Nevada has no ownership registry with identifying numbers.

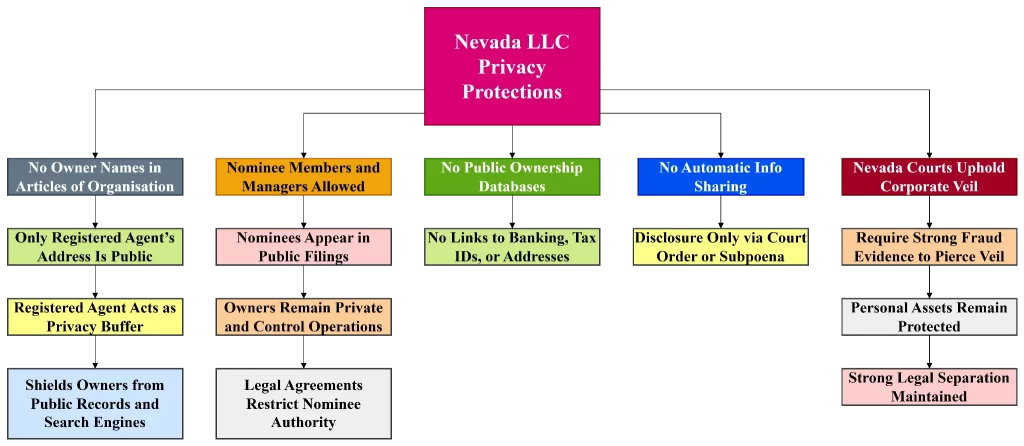

Figure 1: Nevada LLC Privacy Protection (Source: Self-Created)

Nevada business owners have no connection to personal banking, tax IDS, or residential data. Nevada also opposes the automatic sharing of information with government agencies and third parties. No one but a court order or legal subpoena can compel the state to disclose. This provides the business owners and the investors with an additional layer of protection. In addition, they require strong evidence of fraud to strip liability protections from owners. This adds more confidence to the people, knowing that they can guard their assets legally. Nevada’s judicial system takes a veil of incorporation very well. Privacy and legal separation are therefore maintained in most instances.

3.0 Steps to Ensure Maximum Privacy for a Nevada LLC

| Step | Action | Purpose and Notes |

| 1. Use a Registered Agent | The business owner should appoint a commercial registered agent service instead of using a personal address. | This protects the owner’s home address from public records and ensures legal compliance. Professional agents such as Northwest Registered Agent offer these services. |

| 2. Appoint a Nominee | The LLC may appoint a nominee to appear in public filings rather than the actual owner. | This provides an additional layer of anonymity. Nominee arrangements should be supported by legal documentation to clarify responsibilities and limit liability. |

| 3. Establish Strong Data Privacy Policies | The company should implement internal policies for securely handling personal and client information. | These measures help ensure compliance with Nevada privacy legislation and safeguard sensitive data. Policies should include clear options for data subjects to opt out of data collection. |

| 4. Limit Public Disclosure | The LLC should consider carefully what information is included in annual filings and legal documents. | Nevada requires annual disclosure of members or managers Appointing nominee managers or minimising personal identifiers is advisable. |

| 5. Understand State Privacy Laws | Business owners must remain informed about the Nevada Consumer Privacy Act and related legal obligations. | This ensures that data practices are aligned with local requirements Helping to protect both the business and its clients. |

| 6. Seek Professional Legal Advice | The LLC should consult a solicitor or legal expert with experience in Nevada company and privacy law. | Expert advice ensures legal compliance and supports the development of an effective privacy strategy tailored to the business’s needs. |

Table 1: Steps for Maximum Privacy for a Nevada LLC (Source: Self-Created)

4.0 Comparison with Other Privacy-Friendly States (Delaware, Wyoming)

| Feature | Nevada | Delaware | Wyoming |

| Owner Name Disclosure in Formation Documents | Not required. Owners’ names do not appear in the Articles of Organisation. | Not required. Delaware does not mandate listing member or manager names in formation documents. | Not required. Owners remain anonymous in initial filings with the Secretary of State. |

| Registered Agent Requirement | Mandatory. A registered agent must be based in Nevada and act as the public face of the LLC. | Mandatory. A Delaware-based registered agent is required to serve process and official communications. | Mandatory. A local registered agent is required to maintain compliance. |

| Use of Nominee Officers or Managers | Permitted. Nominees may be listed in public records to protect true ownership. | Permitted. Nominee services are common for maintaining privacy. | Permitted. Wyoming also supports nominee structures for additional anonymity. |

| Public Disclosure of Member/Manager Information | Not required in Articles; however, annual lists filed with the state may include this unless nominees are used. | Not required in public records. Annual filings do not mandate disclosure of members or managers. | Not required. Wyoming maintains strong confidentiality standards, especially in public access databases. |

| Public Access to Ownership Information | Extremely limited. No state-owned registry of beneficial owners or owners with personal details. | Limited. Delaware does not maintain a publicly accessible owner database. | Limited. Ownership details are not disclosed publicly by the state. |

| Information Sharing with Federal or State Agencies | Restricted. Nevada resists information sharing unless legally compelled by subpoena or court order. | More open. Delaware may cooperate with certain federal investigations if appropriate legal channels are followed. | Restricted. Wyoming offers strong protections and typically requires legal action for disclosure. |

| Link to Tax IDS or Banking Information | No direct link. The state does not collect or store banking or SSN/tax ID information in business filings. | No direct link, but federal compliance (e.g. EIN application) may require disclosure. | No direct link. Wyoming filings do not require personal financial identifiers. |

| Corporate Veil Protection | Strong. Courts require clear evidence of fraud to pierce the veil. Asset protection is a recognised strength of Nevada LLCS. | Moderate to strong. Delaware has a developed body of corporate law, but may be more flexible in veil-piercing under some circumstances. | Strong. Wyoming upholds corporate protections rigorously and is favourable for asset shielding. |

| Annual Reporting Requirements | Requires an annual list of officers and managers. Nominees can be used to maintain privacy. | It requires an annual franchise tax and report with minimal identifying information. | It requires an annual report and a small fee, without owner disclosures. |

| Best Use Case | Ideal for those prioritising asset protection, minimal disclosure, and robust court defence of privacy. | Suitable for businesses valuing legal precedent, strong corporate law, and ease of formation. | Excellent for small business owners and holding companies seeking low costs and maximum privacy. |

Table 2: Comparison of Privacy Protections for Nevada LLC and Its Competitors (Source: Self-Created)

5.0 Potential Limitations and How to Overcome Them

Even though Nevada provides excellent privacy protection, no system is complete. Ownership can be disclosed in the course of litigation, court orders, or legal investigations. In cases of a lawsuit filed against an LLC, courts might request disclosure. In such cases, keeping a good record of the operations is of key importance. Operating Agreements, minutes of meetings and legal contracts have to be consistent and transparent. Such materials contribute towards the legitimacy of the LLC and maintain a limited liability status. Gross negligence regarding recordkeeping or intermingling of funds between personal and business substantially diminishes the protections of the law. In turn, owners will therefore need to aggressively maintain corporate boundaries in all financial transactions. Legal compliance will promote privacy and maintain the validity of the protections in legal procedures. The extent of personal anonymity by the LLC owners is also restricted by the banking regulations.

Another limitation is related to the lack of understanding about nominee roles in dealing with LLC filings. Some owners unknowingly hand over decision-making to nominees, thus causing legal problems later. Nominees must not have access to company money/funds, contracts, or control of the operation. Clear agreements must indicate that their role is symbolic and is limited to state filings. Lack of clarification on this may blur the legal boundary between the owners and representatives. Experienced legal professionals, as well as corporate service firms, should be the only ones to rely on for nominees. This prevents the undesirable risk of unwanted liability, taxation matters, or compliance violations in the operation. Finally, reckless behaviour online can weaken any privacy protections that may exist. The company address being published on forums and personal blogs can leak the business owner’s identity. Owners should not tag themselves in the company content or public marketing posts. Identifying such vulnerabilities will enable owners to come up with strategies to strengthen confidentiality.

| Limitation | Explanation | Recommended Solution |

| Court-Ordered Disclosure | Although Nevada protects privacy, ownership can be revealed during lawsuits, investigations, or by court order. | Maintaining complete and transparent records such as Operating Agreements, meeting minutes, and contracts. These documents demonstrate legitimacy and preserve limited liability protection. |

| Poor Recordkeeping or Fund Commingling | Mixing personal and business funds or failing to keep proper records weakens liability protection. | Establishing strict corporate boundaries in all financial transactions. Using separate bank accounts and accounting systems for the LLC. Regular audits and legal reviews are encouraged. |

| Misuse or Misunderstanding of Nominee Roles | Some owners mistakenly give nominees control over company decisions, leading to legal and tax complications. | Using legally binding agreements to define the nominee’s role as symbolic. Nominees must not manage funds, sign contracts, or operate the business. Professional nominee services should be used. |

| Banking and Financial Regulations | While Nevada does not link LLCS to tax IDS or bank details, federal banking laws can expose ownership during account setup. | Opening business accounts using the LLC’s EIN, not personal SSN. Consulting with financial advisers who understand the privacy expectations specific to Nevada LLCS. |

| Online Exposure of Identity | Owners may accidentally expose their connection to the LLC through social media, marketing, or personal websites. | Avoid listing personal details in company content or tagging oneself in public posts. Using general business contact details and considering proxy communications for digital presence. |

| Improper Legal Support | Engaging inexperienced legal professionals or handling filings independently can cause non-compliance. | Retaining experienced corporate lawyers or registered agents familiar with Nevada privacy laws. Ensuring all filings and structures are compliant and privacy-oriented. |

Table 3: Limitations and Mitigation Strategies for LLC Owners’ Privacy Protection in Nevada (Source: Self-Created)

6.0 Conclusion

Nevada is still the most privacy-oriented state for creating an LLC. Its regulations are aimed at protecting the anonymity of ownership, eliminating unnecessary disclosure, and providing legal security. The privacy laws in Nevada are more encompassing and settled than those in Delaware and Wyoming. From the formation to the daily operations, its structure aims at confidentiality and autonomy. Nominee services, veil protection, and simple state reporting requirements are an advantage for owners. However, these legal benefits provided by the government have to be implemented properly to be effective. By engaging professional services, regulating legal documents, and reducing digital exposure, owners of LLCS can protect their identity and safely operate within legal limits. The state of Nevada’s privacy laws offer a unique benefit within the context of today’s business scene, which is transparency-oriented. Nevada is still the number one destination for those looking for strict confidentiality without damaging their legitimacy.

Leave a Reply