1.0 Introduction

A lot of people engage in side hustles to earn extra income or pursue personal interests. Such ventures usually start on an informal, unstructured, and unaided basis with no long-term planning. However, as growth increases with time, formalisation is essential. Nevada, its business-friendly policies, and its favourable tax climate make it a compelling option for filing a limited liability company (LLC).

The report aims to discuss how someone can take their informal or part-time business activity (a side hustle) and turn it into a legally recognised and officially registered business entity (LLC) in the state of Nevada. It starts with the identification of the signs that tell it is time to take that step. The report goes on to explain the benefits of registering an LLC in Nevada and then provides a detailed step-by-step registration guide. Problems that are common during the transition and how to address these problems are also discussed. Finally, the report addresses how business growth can be managed without violating the law and how the law operates. The aim is to help incoming entrepreneurs effectively and responsibly within the transition process.

2.0 Signs It’s Time to Turn Your Side Hustle into an LLC

At some moment in every business development, there occurs a moment when informality proves to be a drawback. Consistent and increased revenue generation is one very important indicator of when a side hustle should be formalised. If a side business starts generating a dependable minimum income or does better than expected, then it becomes viable. It is at this stage that more than just practical, formalising the structure of the business is crucial for sustainability. The other one is when the number of customers increases and marketing efforts start to grow. By having more visibility, there are also more expectations required, which include the client, brand reputation, and legal standards. An LLC creates a legal structure to deal with such increased exposure.

Liability issues also come with business expansion. In the absence of formal registration, personal assets can be a risk in case of legal disputes. An LLC maintains a distinction between the personal and business liabilities, which is much-needed protection. And also, when a side hustle starts to hire subcontractors or employees, or if it involves extensive contracts, a formal incorporation is needed. Finally, when the owner of the business begins to look for funding or a partner or seeks a loan, an LLC adds credibility and legitimacy in the eyes of investors and lenders in Nevada.

3.0 Benefits of LLC Formation for Small Businesses

Incorporating into a limited liability company brings a series of benefits for businessmen who make the transition from informal operations. “Liability protection” is the greatest benefit Nevada provides to side hustlers. Juridically, a Nevada LLC also protects the owner from being personally liable for the business. This means that the owner’s personal assets may not be used to settle lawsuits or debt acquired by the business. The other major advantage is “tax flexibility”. Nevada LLCS are pass-through entities, and hence, the business income will not be taxed twice at the state and federal levels; it will only be taxed once on the owner’s tax return. It also helps with the reputation of the business to form an LLC. Formal entities are often trusted by clients, partners, and vendors more than non-formal operations. The opening of business bank accounts in Nevada is an easier process for a company with the status of an LLC.

Another benefit is “operational flexibility”. Nevada LLC do not have any strict corporate formalities it needs to follow, which include annual meetings and a strict governance structure. This flexibility goes well with entrepreneurs or small groups of people who are new to the entrepreneurship world. Furthermore, Nevada also has strong privacy preservation for business owners. The owners do not have to show their personal information to the Nevada regulatory bodies, and this ensures more confidentiality. The LLCS in Nevada are therefore some of the most business-friendly in the USA, with the assistance of favourable asset protection laws. [Refer to Table 1 for complete details].

| Benefit | Demonstrating the Impact for Side Hustlers |

| Protecting Personal Assets | Helping owners avoid risking their jobs. Savings when facing lawsuits or financial losses. |

| Enjoying Tax Efficiency | Enabling more profits to be retained Avoidance of double taxation in Nevada. |

| Avoiding State Income Taxes | Supporting long-term savings. Enhancement of the company’s finances. |

| Building Business Credibility | Promoting better professional opportunities and cooperation, as well as improving client belief. |

| Allowing Operational Flexibility | Making it easier for sole traders or small teams to adapt and manage daily tasks. |

| Maintaining Owner Privacy | Securing confidentiality and reducing the risk of unwanted attention or identity fraud. |

| Strengthening Asset Protection | Providing peace of mind and lowering legal vulnerability during challenging business conditions. |

Table 1: Benefits of LLC Formation for Small Nevada Businesses (Source: Self-Created)

4.0 Step-by-Step Guide to Officially Register Your Business

Starting a side hustle and converting it into a Nevada LLC has several steps. These steps are explained thoroughly in the following Table 2.

| Step | Action | Description |

| 1 | Choose a Business Name | Select a unique name that includes “LLC” or “Limited Liability Company.” Ensure it is distinguishable from existing registered names in Nevada. |

| 2 | Appoint a Registered Agent | Designating a Nevada-based individual or service to receive legal and state documents on behalf of the LLC. |

| 3 | File Articles of Organisation | Submitting official formation documents to the Nevada Secretary of State online or by mail. Including details such as name, address, and management structure. |

| 4 | Obtain a Nevada Business License | Applying for a state business license is required for all Nevada LLCS. Renewing annually to maintain good standing. |

| 5 | Draft an Operating Agreement | Create an internal document outlining ownership, management roles, and operating procedures. While optional, it is strongly recommended. |

| 6 | Apply for an EIN | Obtaining a free Employer Identification Number (EIN) from the IRS. This is required for tax filing, opening bank accounts, and hiring employees. |

| 7 | Register for State Taxes (if applicable) | Depending on business type, register for sales tax or other relevant state taxes through the Nevada Department of Taxation. |

Table 2: Step-by-Step Guide for Business Registration in Nevada (Source: Self-Created)

5.0 Common Challenges and How to Handle Them

However, even with the obvious advantages, there are hurdles to overcome when changing from a side hustle to a Nevada LLC. “Underestimation of the time and administrative work” is among the most widespread drawbacks. Entrepreneurs tend to feel that registration is a once-in-a-lifetime process without understanding the responsibilities that come after. There are regular filings, renewals, and compliance obligations to be followed to avoid penalties. Another big problem is “compliance costs and responsibilities”: state filing fees, yearly business licence renewals, and the need to make appointments and maintain a registered agent. Such recurring burdens can be financial and administrative burdens for new business owners. Another of the main challenges is “increased complexity,” in contrast to functioning as a sole proprietor. Nevada LLC demands proper documentation, legal structuring, and increased administrative control, which could be frightening to those who do not understand business operations.

One more barrier refers to “legal and operational requirements” that include such things as sending the reports to the IRS and following state-level requirements. Many entrepreneurs are struggling with “separating business and personal finances”, which is critical for maintaining Nevada LLC’s liability protection. This usually involves opening separate business accounts and maintaining records with sensitivity. Finally, “transferability of ownership” can be limiting because many LLCS require member consent for the change of ownership. These issues, if not countered early in the course of business, can affect the operations and survival of the business. However, by proper preparation and professional assistance, they can be managed, and there will be a smooth transition and long-term compliance. In order to mitigate the above challenges, a detailed Table 3 is illustrated below.

| Challenge | Handling the Challenge in Nevada |

| Underestimating time and administrative work | Setting reminders for deadlines and creating compliance calendars. Considering using professional services or software to assist with managing ongoing administrative tasks. |

| Managing compliance costs and responsibilities | Budgeting for recurring costs early. Researching affordable service providers or appointing oneself as the registered Nevada agent, where possible. |

| Navigating increased complexity | Seeking legal or business advice during the formation process. Using trusted templates for documents such as operating agreements and keeping clear organisational records. |

| Meeting legal and operational requirements | Staying informed by subscribing to government updates. Consulting with legal or financial advisors to ensure accurate and timely submissions. |

| Separating business and personal finances | Opening dedicated business bank accounts and credit cards. Keeping accurate financial records and separating all business transactions from personal ones. |

| Handling transferability of ownership | Creating a detailed operating agreement with clear rules for ownership changes, member exits, and dispute resolution. Keeping members aligned through regular communication. |

Table 3: Measures Taken for Mitigating the Challenges (Source: Self-Created)

6.0 Managing Your Business Growth and Compliance

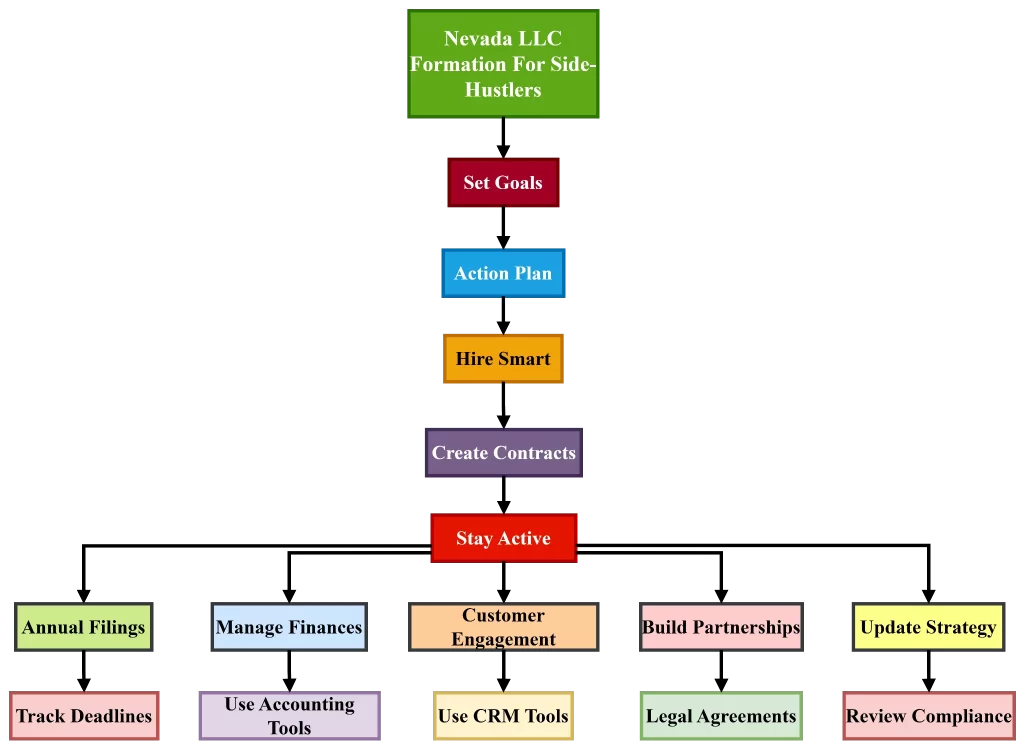

Growth and persistent compliance should be the next order after an LLC is set up. Controlling the growth process starts with the establishment of clear business objectives. Such objectives should reflect in the company’s mission and should be accompanied by actionable plans with features such as marketing, product development, and customer engagement strategies. It is important to hire the right people to scale operations. Entrepreneurs should keep cultural fit, technical fit, and long-term commitment in mind when recruiting new members to join their teams. There should be contractual agreements and employment policies to ensure clarity and legal regulations. Continuous compliance means that one must pay attention to both state regulations and federal regulations. In Nevada, LLC businesses need to present an annual list of managers or members and renew their business license annually. One may face administrative dissolution or fines for failure to fulfil these obligations. Calendars or software tools should be used by the entrepreneurs to follow up on their deadlines and meet submission dates.

Figure 1: Nevada LLC Formation for Side-Hustlers (Source: Self-Created)

Another important aspect of compliance is the proper financial records. Nevada business owners should incorporate the use of accounting software to track expenditures, prepare for taxes, and facilitate cash flow management. Clear and precise record keeping not only facilitates compliance but also influences strategic decision-making. Consulting with customers and receiving complaints helps improve offerings and build loyalty. As the business flourishes, being in touch with its customers or clients guarantees relevance and flexibility. Adoption of customer relationship management tools can help establish this relationship. They also include strategic partnerships and networking to improve growth. If entrepreneurs decide to cooperate with other Nevada firms, they can enter new markets, share resources, and improve brand visibility. Such partnerships should be formalised using legal documents and should fit into the long-term business goals. Lastly, regular updates to the operating agreement, business strategy, and the company’s status regarding compliance keep the company in a better position with changing needs.

7.0 Conclusion

The move to make a side hustle into any formal business structure is a significant milestone for those who wish to be entrepreneurs. Once a side business shows signs of growth, burden of responsibility, and profits, the creation of a Nevada LLC would be a wise and tactful decision. This structure offers key advantages, such as liability protection, among others, tax advantages, and enhanced credibility as a way of operation. Although the registration and compliance process might appear overwhelming initially, having a structured approach secures a smooth transition process. In proactively tackling common challenges and having systems to facilitate growth and compliance with the law, Nevada business owners will be able to position themselves for success in the long term. This favourable business environment provides additional incentive, with unique benefits that are not available in other states. Through the right mindset, investments and planning, side hustlers can transform themselves into established entrepreneurs.

Leave a Reply