1. Introduction

A strong idea and entrepreneurial spirit are not enough to create a successful business. One of the most valuable yet underutilised business credit tools for sustaining and scaling operations is financial health. The foundation for establishing business credit is already laid down for those who have decided to establish an LLC in Nevada. Knowing how to use a Nevada LLC to build strong credit will open up financial doors, business partnerships, and long-term business growth. Personal and business credit are two different kinds of credit that necessitate different approaches to each, which is supported by different financial and operational strategies.

This report is aimed to help entrepreneurs and business owners learn how to use their Nevada LLC to build and maintain business credit. The business credit importance, key steps to building a strong credit profile, the benefits of Nevada as a business hub and more is explored. The last part of the discussion provides the ways of maintaining good credit as well as utilising credit to your advantage as a means of expanding your business.

2. What is Business Credit and Why Does It Matter

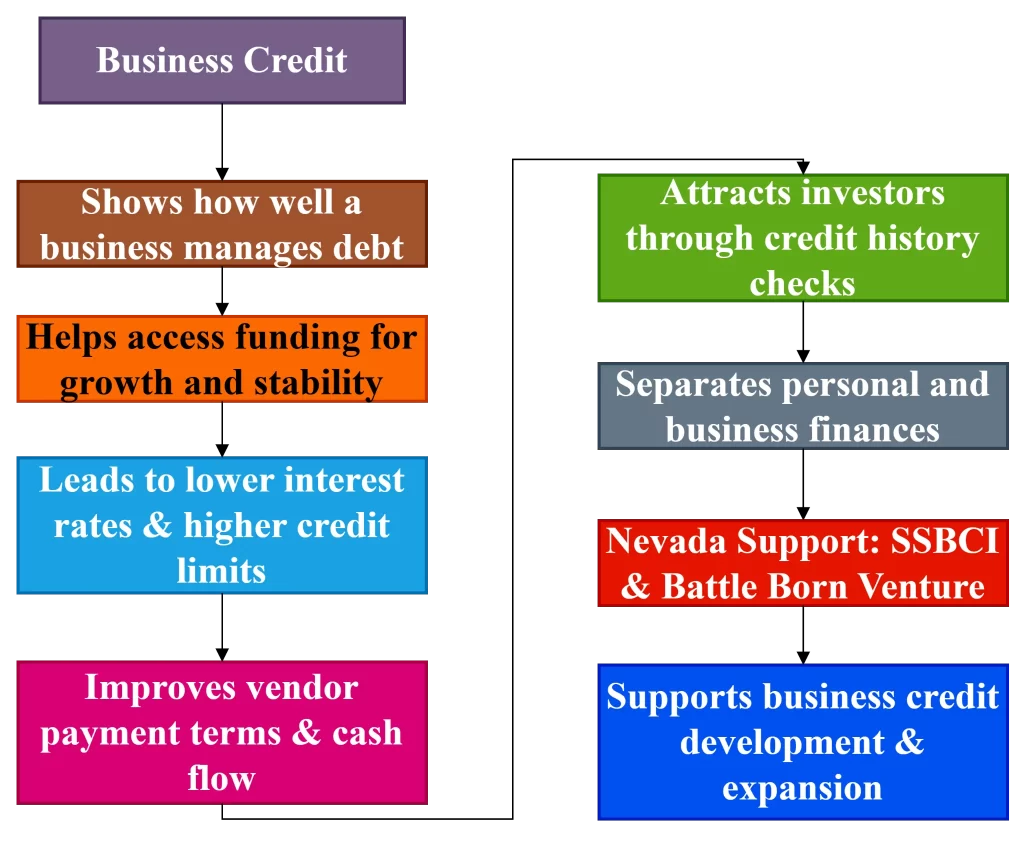

Business credit is essentially the business’s creditworthiness, that is, how good the company is at managing debt and paying its credit obligations. Like in other states, business credit is a substantial contributor to company expansion and success in Nevada. Creating a great business credit profile makes it easier to access funding, which is a critical need in expanding a business, maintaining operational stability, and addressing unforeseen financial problems. Providers of business credit, such as banks and other lenders, are more apt to certify loans or grants for lines of credit for businesses that have sound credit. Other reasons include the fact that favourable business credit may imply lower interest rates, higher credit limits, and more flexibility in paying the money back, making financing more affordable and possible.

Figure 1: Business Credit (Source: Self-Created)

Besides, Nevada investors will also be more ready to offer businesses with an impeccable reputation better payment terms, to enhance cash flow and inventory management. Investors will research a business’s background and its credit history in order to verify the financial health of the business and the risk, including liabilities to its creditors. Establishing good business credit in Nevada also helps to keep the company’s finances separate from the company owner’s finances, avoiding confusing business with personal spending and protecting both legally and financially. In Nevada, the State Small Business Credit Initiative (SSBCI) and Battle Born Venture help small business owners through state-funded programs, which further aid small business growth and discovery. These programs include resources to help companies build, improve, and maintain a good credit record.

3. How a Nevada LLC Helps Establish Business Credit

Creating an LLC in Nevada offers numerous benefits directly supporting to business credit development. Nevada is well known for having a pro-business legal framework, including strong privacy protections, which hide owner identities, and no state corporate income tax. These aspects contribute to easier compliance and financial management, which are essential elements of establishing solid credit [Refer to Table 1 below].

| Action | Purpose | Nevada-Specific Relevance | Credit-Building Benefit | Example |

| Separating finances | Keeping business and personal assets legally distinct | Required for legal compliance and liability protection in Nevada | Enables creation of a separate business credit profile | Opening a Nevada-based business bank account under the LLC’s name |

| Registering an LLC | Forming a distinct legal entity recognised by Nevada law | Nevada provides business-friendly laws and privacy protection | Establishes eligibility for business credit independent of the owner | Filing Articles of Organisation with the Nevada Secretary of State |

| Obtaining an EIN | Securing a federal tax ID to identify the business | Required for all Nevada LLCs engaging in commerce | Needed for credit applications and opening financial accounts | Using the EIN to apply for business credit cards or lines of credit |

| Opening business accounts | Setting up accounts solely for business income and expenses | Nevada banks often require state LLC documentation and an EIN | Builds transaction history and credibility with lenders and suppliers | Maintaining a consistent payment record through a Nevada-based business bank |

| Establishing trade credit | Building a payment history with vendors and suppliers | Helps Nevada LLCs grow without upfront cash through local suppliers | Strengthens credit score through positive repayment behaviour | Using net-30 accounts with Nevada-based office suppliers |

Table 1: Importance of Business Credit in Nevada LLC (Source: Self-Created)

4. Step-by-Step Guide to Building Your Business Credit Profile

Establishing the business credit with a Nevada LLC starts with legalising the business structure and continues in a sequence of step-by-step processes. These processes are outlined in Table 2 below.

| Step | Action | Purpose | Nevada-Specific Insight | Credit-Building Benefit | Example/Resource | Tracking Tip |

| 1 | Opening a business account | Establishing a financial foundation and proving business activity | Nevada State Bank offers accounts like Business Growth Checking and Community Checking | Begin business transaction history and separate finances | Business Growth Checking from Nevada State Bank | Track monthly transactions and deposits |

| 2 | Applying for a credit line | Creating a revolving credit history to show repayment behaviour | Nevada State Bank provides business credit cards and revolving lines of credit | Builds credit with consistent repayments | Nevada State Bank Revolving Business Line of Credit | Record drawdowns and repayment history |

| 3 | Registering your business | Making your business a legal and recognised entity in Nevada | Must file with the Nevada Secretary of State and maintain a business license | Legal registration is a prerequisite for a separate credit profile | Nevada SilverFlume Business Portal | Store registration documents in a secure location |

| 4 | Getting an EIN | Acquiring a Federal Tax ID for business operations and credit applications | Mandatory for Nevada LLCs when opening bank accounts or applying for loans | Enables applications for bank accounts, credit, and supplier relationships | IRS website (irs.gov) | Save the EIN confirmation notices for future use |

| 5 | Paying bills on time | Maintaining a positive payment history with creditors and suppliers | Nevada vendors often report to credit bureaus, influencing your credit score | Strengthens credit score and lender confidence | Paying rent, utilities, and vendor invoices on time | Set auto-reminders or automatic payments |

| 6 | Establishing vendor credit | Creating tradelines through vendor agreements with reporting practices | Use Nevada-based vendors that report to bureaus like Dun & Bradstreet or Experian | Boosts credit file with trade references | Net-30 terms with local office suppliers | Log invoices paid early or on time |

| 7 | Accepting card payments | Demonstrating sales volume and credibility through merchant processors | Choose a Nevada merchant provider that reports to business credit agencies | Helps credit if the processor reports positive activity | Square, Stripe, or local banks in Nevada | Monitor merchant statements regularly |

| 8 | Monitoring your credit | Ensuring the accuracy of credit reports and correcting errors quickly | Regular checks through Experian Business, Equifax, or Nav help track progress | Allows timely corrections and better credit strategy | Free credit tools like Nav.com or Experian | Review credit profile quarterly |

Table 2: Building a Business Credit Profile in Nevada Process (Source: Self-Created)

5. Tips for Maintaining and Improving Your Credit Score

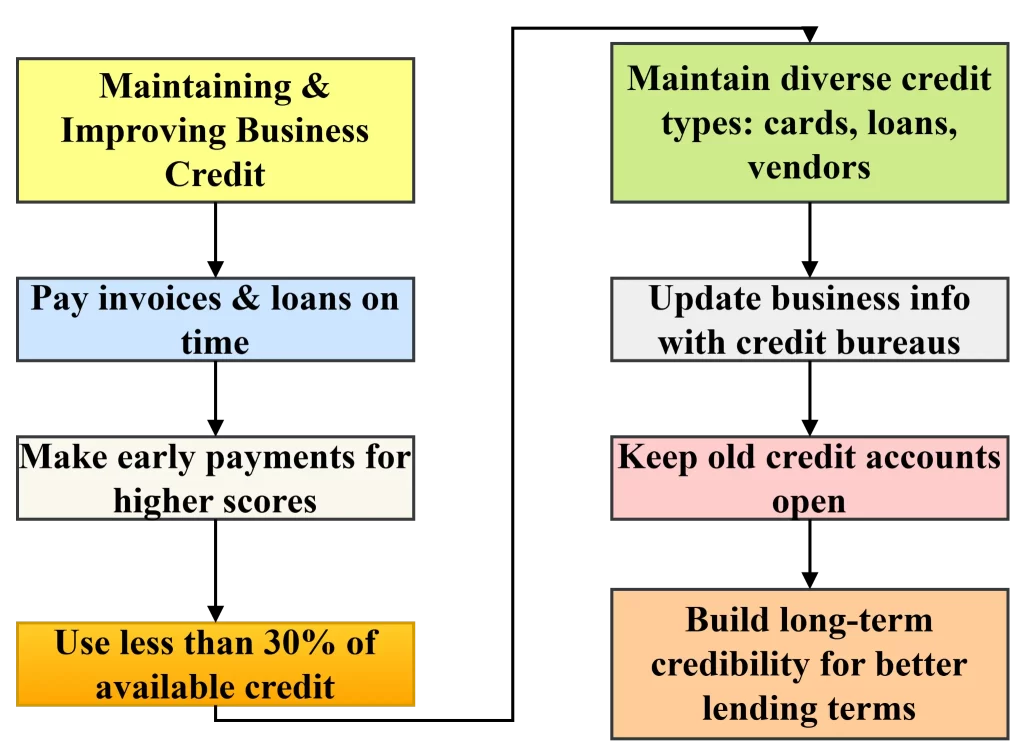

In order to improve a business’s credit score, one needs to constantly invest in good financial management and planning. This is why payment history continues to be the most important factor when determining credit scores. Nevada businesses should always try to pay all invoices, loan instalments and credit card balances on time. In fact, credit bureaus tend to favour early payments, which lead to higher credit scores. Credit utilisation is also a very key factor. Nevada businesses should not use all their credit and instead use only a small fraction of it, ideally, less than 30% of it. This is a financially responsible choice and lowers the chance of default, according to lenders. Also, a diverse mix of credit, maintained over the years, can improve a credit profile. A business is capable of managing different types of financial obligations by utilising a combination of vendor credit, credit cards and loans. However, only take on credit that is needed, and that won’t stress the revenue streams of the company.

Figure 2: Tips for Maintaining and Improving Your Credit Score (Source: Self-Created)

This also means that it’s a good idea for business owners to regularly make updates to their business information on credit bureaus. Minutes can be submitted if there is a change of address and contact details or when the ownership structure has changed, to avoid discrepancies that might alert lenders or potential partners. It all depends on the length of the credit history, too. Older accounts that remain open, even if in disuse, serve to increase average credit age and make for good credibility. On the contrary, closing old accounts lowers the overall score. The consistent reliability of a business in Nevada, however, predisposes the business to be favoured by more flexible and reduced lending terms and vendor agreements.

6. Leveraging Business Credit for Growth and Financing Opportunities

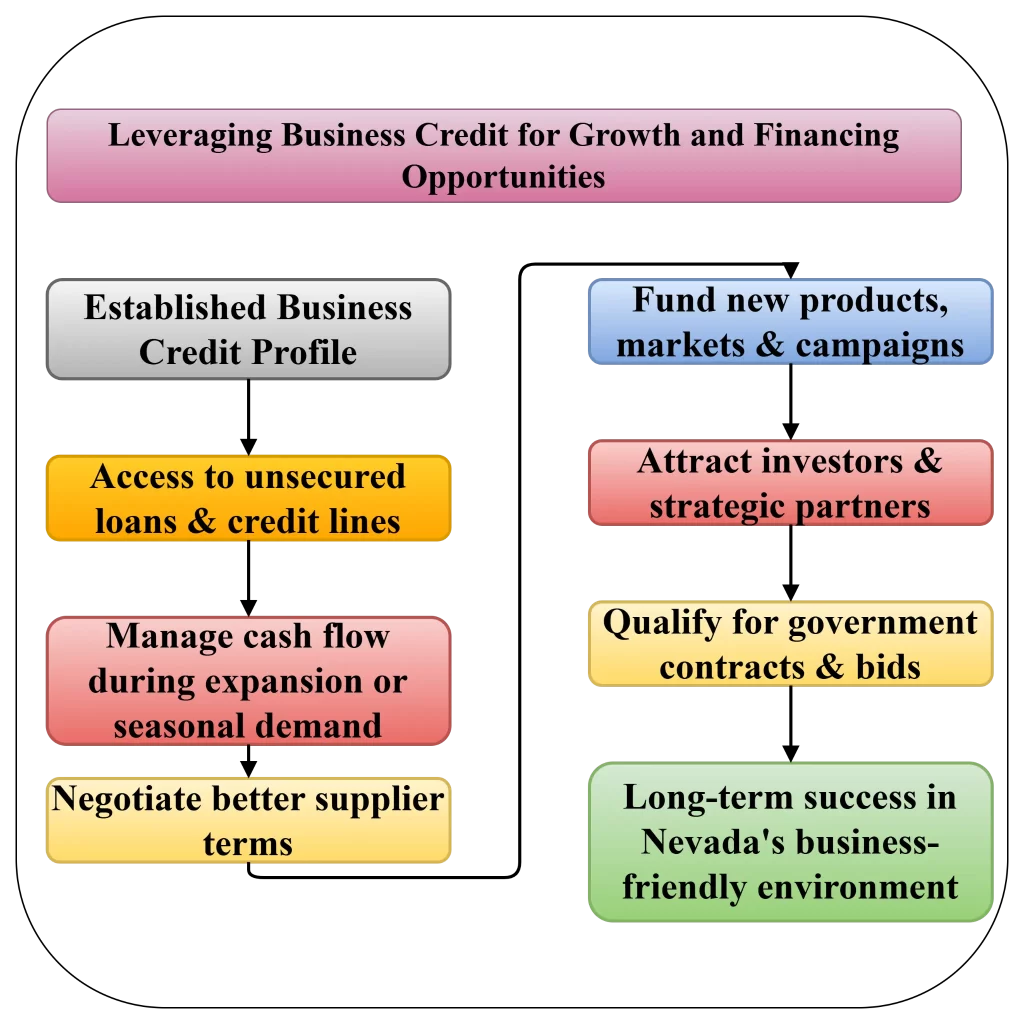

After a Nevada LLC has established a robust business credit profile, the benefits are not only operational convenience but also an improved credit rating. Business credit is a powerful tool to scale the company and reach certain strategic goals. A good credit score lets a business qualify for unsecured loans and lines of credit, which offer flexible financing with no collateral. It can be particularly important during times of expansion or at least when working through seasonality volumes of cash flow. Furthermore, having business credit makes it easier to work with suppliers to pay within longer terms. Even Nevada companies can use credit to attract new markets or introduce new product lines. For example, financing can be used to fund market research and enter into distribution agreements or support advertising campaigns. Each of these efforts contributes to growth but often lacks the capital on hand, beyond revenues, to support it.

Figure 3: Leveraging Business Credit for Growth and Financing Opportunities (Source: Self-Created)

Mergers, acquisitions or partnerships are also important during the business credit period. A good credit profile lets a Nevada LLC business appear attractive to various investors and collaborators due to its financial stability. This is a signifier of both the company’s practice of management and its operational maturity. Although many Nevada businesses use their credit history for business purposes, there are a select few that utilise their credit history to secure government contracts or to participate in bidding processes that involve a substantial need to demonstrate the business’s financial reliability. Business credit scores are considered part of many public and private procurement system evaluation criteria. Due to the fact that there are so many built-in advantages to Nevada LLCs, it’s a great place to take advantage of these opportunities. There is a legal and regulatory environment here that facilitates flexibility and anonymity, where businesses can go after financing or partnerships without hesitation. When planned and executed correctly, business credit goes from being merely a financial tool to being a strategic asset working to fuel long-term success.

7. Conclusion

Setting up a new venture without any idea of how to build business credit is a disadvantage because it makes all the difference between success and failure. Unfortunately, people operating a Nevada LLC have structural advantages over their peers (i.e., tax benefits & privacy protections), which makes it easier for them to build and use business credit. Nevada’s business-friendly environment and business credit profiles enjoy a strong base from which to grow and develop their services. Forming the LLC, registering the company with the credit bureaus, opening vendor accounts, and eventually taking out loans increases the credibility of the enterprise and makes taking funds in and out of the company easier. From a business standpoint, taking responsible action in terms of financial practices protects the credit and keeps the business in the running for opportunities and growth in the future. By taking responsible action regarding financial practices, businesses not only protect their credit but also make themselves available for opportunities and growth in the future.

Leave a Reply