1. Introduction

Employees around the world are changing their working styles based on new technologies and new professional standards, and the phenomenon of digital nomads is becoming more popular in the 21st century. These new types of workers, no longer physically tethered to a fixed location, look for flexibility, freedom in working hours, and a costless approach to work and life. As people remained working from home, especially with the emergence and growth of the COVID-19 pandemic, the possibilities of running a business from any corner of the globe have emerged. The next sections of this report shall look at why more and more digital nomads are setting up their LLC in Nevada. The experiences to be covered will include what makes Nevada unique, the advantages that the state offers for remote entrepreneurs, a how-to guide on forming an LLC in the state, and an overview of taxes and compliance for people abroad. Last, the report will describe some of the challenges that digital nomads can encounter during this process and what they can do to avoid them.

2. Why Digital Nomads Prefer Nevada

The needs of digital nomads differ from those of a typical home-based business owner in several ways. The opportunity to develop offices and businesses in different countries implies a very low governing impact and maximum organisational independence. Nevada has emerged as a favored jurisdiction and business setup hub among this demographic for several reasons. First of all, they are well aware that Nevada has one of the most attractive business climates in the United States. It also has a rich history of supporting entrepreneurial pursuits, most recently through generally favorable legislation that helps LLCs. LLC members are not obliged to be physically located or residing in Nevada, and that may be a big plus for nomadic types. Additionally, there is no state income tax levied on either individuals or corporations in Nevada.

The absence of income tax is one of the many features that attract location-independent workers who would prefer to avoid paying as much tax as possible. Relative to other states, which either impose higher taxes or have multifaceted forms to complete, Nevada is fairly simple and uncluttered. Privacy is another major incentive. Nevada is famous for its generous policies for business owners’ identity. It is possible to form an LLCS without the information to go public about the names of the members or managers. This is especially important if the user is a digital nomad and has personal information that is easily accessed online.

3. Benefits of Nevada LLCS for Remote Workers

| Category | Feature | For Remote Workers |

| Tax Advantages | No State Income Tax | Reducing the overall tax burden and increasing net income for remote entrepreneurs. |

| No Franchise Tax | Simplifying financial planning by removing recurring state franchise fees. | |

| No Estate Tax | Supporting long-term wealth planning and inheritance considerations. | |

| Low Property Taxes | Lowering operational costs for nomads leasing or investing in property. | |

| Privacy & Asset Protection | Enhanced Privacy | Protecting individual identity when managing business across borders. |

| Strong Asset Protection | Shielding personal assets from business-related debts and legal claims. | |

| Flexibility & Simplicity | Flexible Management Structures | Allowing remote workers to structure their business to fit their mobile lifestyle. |

| Streamlined Corporate Formalities | Minimising bureaucracy and allowing greater focus on remote operations. | |

| Fast Registration | Enabling swift business formation from anywhere in the world. | |

| Other Considerations | No Residency Requirement | Allowing digital nomads to register a business without living in Nevada. |

| Charging Order Protection | Enhancing security against creditor actions by protecting business interests. | |

| No Requirement for Physical Office | Running an entirely remote operation without needing a fixed office in Nevada. |

Table 1: Benefits of Nevada LLCS for Remote Workers (Source: Self-Created)

4. How to Establish Your Nevada LLC as a Digital Nomad

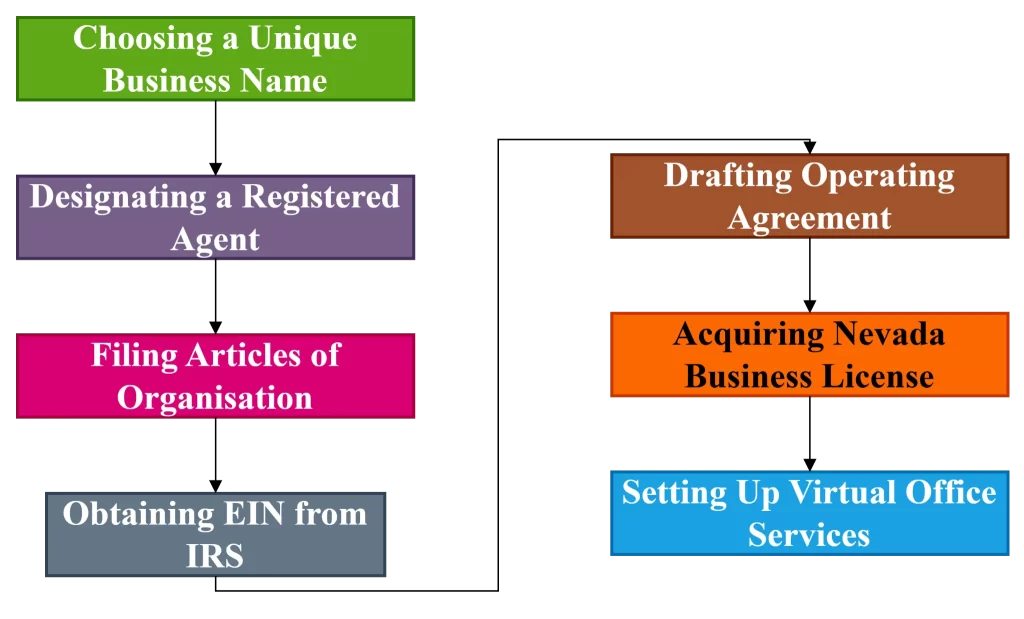

While it is by no means a complicated process to form an LLC in Nevada for digital nomads, factors need to be considered to effectively follow through. It starts with choosing an appropriate business name and continues through to signing the sale agreement. The name must include the term “LLC” and cannot resemble names of registered entities in the state. Next, those wanting to embrace digital nomadism in the state of Nevada have to appoint a registered agent. They serve as the legal liaison for the documents going to and coming from the state authorities. As most of the digital nomads do not stay in Nevada, it is quite normal to have a professional registered agent service, many of which provide digital notice facilities and scan one’s mail.

Figure 1: Nevada LLC as a Digital Nomad Process (Source: Self-Created)

The third step is submitting the Articles of Organisation to the Secretary of State of Nevada. This document will summaries details like the name of the LLC, the name of the registered agent and whether the LLC will be member-managed or manager-managed. The filings can also be made through the Internet, and one can choose to have the paperwork processed quickly for an extra charge. After registering an LLC, business owners should apply for an EIN from the IRS. This is important in the processing of bank accounts for business, for paying tax, and the employment of employees or the hiring of contractors. The application is also free and may be filled out online regardless of the country.

While Nevada does not require an operating agreement, it is recommended for digital nomads to include one in the formation of a company. An operating agreement provides the structure, guides member conduct and allocation of responsibilities, eliminating conflicts in the LLC. It is especially useful when managing remote employees or cooperating with contractors. Moreover, depending on the type of activities a digital nomad performs, they might also have to apply for a Nevada State Business License. This is an annual filing and needs to be filed to maintain the LLC in good standing. It is available at the Secretary of State’s website, and it costs around $200 per annum. For those customers who would like to have their mail delivered to them or receive telephone calls at their physical addresses, virtual office services in Nevada can provide a physical address and also forward all mail received to the concerned client after scanning it, as well as answer telephone calls on behalf of the client. Such services enable the nomadic persons to conduct their business interests within the state, even without a physical presence.

5. Managing Taxes and Compliance from Abroad

Tax is an unavoidable reality of living and working from anywhere, so staying abreast of international taxation laws is mandatory for digital nomads. Tax residency is the key to taxation rights, which defines in which country the income is taxable. Most countries use physical presence, permanent home, or vital interest tests for the residency issue, essentially conning people who spend more than 183 days in that specific country. However, there is a remarkable challenge to internationalisation in America than in other countries today. The U.S taxes their citizens on their global income irrespective of their location in the world today. This means that America’s nomads have to come filing their taxes annually, and they are likely to be taxed under both local taxes and international taxes.

Accordingly, nomads should look for ways of not being subjected to double taxation, such as the FEIE or the FTC. Managing how much time is to be spent within a certain country, the ability to evaluate the laws of the different countries and lastly being able to exercise the provisions of the various tax treaties are key in compliance. Moreover, avoiding tax residency in low- or no-tax countries, monitoring geolocation data, and contacting expatriate tax advisers can help with that. However, Nevada does not have these tax issues. That is why digital nomads mostly prefer Nevada for expanding their businesses.

At the federal level, digital nomads can manage tax issues by filing US tax returns and declaring income. Depending on the choice of the legal structure of the LLC, it will be a sole-member entity disregarded for tax purposes, a multi-member entity that files a partnership return, or it will be taxed as a corporation, so federal income tax returns and schedules vary. For example, a single-member LLC will use the owner’s Form 1040 with Schedule C to report its income. Overall, acting beforehand, timely filing, keeping records, and understanding the Nevada laws will assist digital nomads to meet their tax requirements worldwide and get the most out of the available benefits.

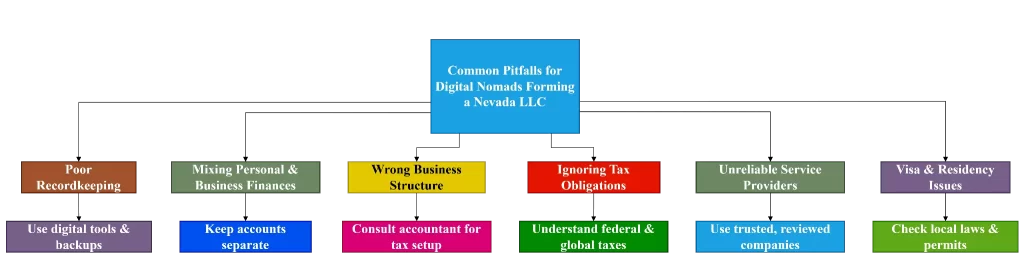

6. Common Pitfalls and How to Avoid Them

While the formation of an LLC in Nevada has numerous benefits, digital nomads may experience specific difficulties if they are unprepared for them. Being aware of these issues, nomads will exercise more caution in their choices and ensure they run a clean business. The first mistake is a lack of record-keeping. When working remotely, it could be tough to keep an eye on receipts, invoices, and compliance documents while on the go. Then it becomes hard to file taxes or even to prove the business’s existence or legitimacy in case of an audit. This should be avoided thus, nomads should ensure the following best practices the nomads should ensure that to maintain order, they should have a good digital bookkeeping system, besides they should make copies of all records securely.

A common mistake is the lack of a clear division between private and business expenditures. Despite the notion that digital nomads spend time in cafes or other rental spaces or their home offices, personal mingling with business should be avoided to ensure that liability does not influence the LLC’s protection. All business-related expenses should be made from the business account, while personal expenses should be paid from the person’s account. In the same way, choosing the wrong business structure creates problems. However, for specific purposes, some of the digital nomads may find it useful to choose S-Corp as the tax status for their LLCs. But this means more elaborate forms and continual reporting of payrolls. There is no clear-cut solution to the matter of taxonomy; if it is possible, one should consult with an accountant before making the decision.

Figure 2: Common Pitfall for Digital Nomad (Source: Self-Created)

Further, some nomads even think that company formation in Nevada frees them from all tax responsibilities. Although state taxes may not be high, federal taxes, together with international laws, are still present. Failure to meet or satisfy these provisions may lead to sanctions or a loss of foreign income exemptions. Another type of risk is hiring unreliable service providers. Some of the digital nomads’ resort to contracting third-party agents to incorporate their LLCs or handle their mail services. Using reputable companies ensures that customers get to learn the real charges required in the undertaking of such a project and ensure that there will be appropriate responses when they arise. Digital nomads might underestimate visa and residency issues. In simple terms, forming an LLC in Nevada does not give one a work permit in other countries. In some host countries, business operations may be restricted by the need to acquire special permits or make regular reports.

7. Conclusion

As outlined in this report, there are several justifications for digital nomads to establish LLCs in Nevada, and most of them were discussed in this report. Nevada has very attractive taxes, friendly laws for businesses, and good privacy standards, making it a suitable environment for nomads who want legal and financial ease. The report also discussed the opportunities Nevada LLC offers remote workers, including legal protection and simplified formation, credibility, and operational assistance. In addition, it provided details on the necessary legal processes digital nomads have to go through to set up their LLCs. Finally, this report proved that Nevada can be an attractive destination for digital nomads creating and growing their businesses while being location-independent. Becoming aware of the legal and tax environment in Nevada, digital nomads were able to be more flexible, effective, and safe in the globally connected world.

Leave a Reply